Posted by Maria T. Hurd, CPA, RPA

Inquiring minds want to know – Are the Bonuses In or Out? How Can I Withhold from a Gift Card? It’s Not Cash! … and more …

The Problem

The use of an incorrect definition of compensation for contribution purposes continues to be listed as the most common error the IRS finds during their audits, and not surprisingly, it is the most common error we find during our audits of plan financial statements.

But, But, But, But…

Some typical statements we hear in response to the identification of a compensation error include:

- But the owner told me he wanted people to receive their full bonus and not to withhold from it!

- But how can I withhold from a gift card or a prize?

- But we’ve never included the taxable parking allowance!

- But manual checks never get coded for deferral withholdings!

The Reasons for the Mistake

The bottom line reasons for why incorrect definitions of compensation get used are:

- lack of knowledge of the plan document provisions regarding eligible compensation;

- owners think they can change the plan operations without changing the plan document;

- payroll person does not think withholding from noncash compensation is possible;

- new compensation types are added but not properly coded manual checks;

How to Include or Exclude Compensation Types

Excluding or including certain types of compensation is generally possible if the definition of compensation is not discriminatory. Although the permitted difference between includible compensation for HCEs and NHCEs under Internal Revenue Code Section 414(s) is not a black-and-white test, the industry generally uses a 3% differential as acceptable.

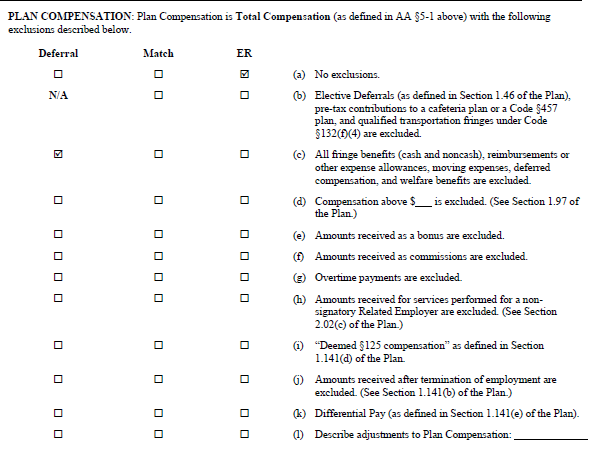

Each plan sponsor must consider their business goals in conjunction with the administrative capabilities of their payroll software and their personnel when selecting what types of compensation to include or exclude. Most employers are able to make the selection on their adoption agreements, which generally offer the following options, with an “Other” option in case they need to customize the definition to exclude specific items not mentioned on the standard list.

Separate Elections for Irregular Pay

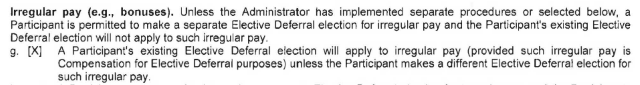

One common question we get is whether clients can get separate elections for bonus payments and other irregular pay. The ideal way to accomplish that administratively is for the plan document to permit separate elections for irregular pay as follows:

Some plan sponsors take the position that if the plan allows a person to change a deferral election at any time, a separate election for a bonus is effectively two changes in deferral elections, one before the bonus payment, and another one to go back to the regular election. This could become logistically problematic if the bonus pay happens on a pay date and the regular election is still withheld from the regular pay.

In the end, the plan sponsor can control what type of compensation is included for contribution purposes through the plan provisions.

The key is to: Make Rules You Intend to Follow, and Follow the Rules You Make!

Be sure to check out the other blogs in our Tips and Traps of Compensation Series:

Part I: The Trouble with True-Ups or Lack of True-Ups

Part II: What’s the Catch with Administering Catch-Up Contributions

Part III: Double Jeopardy: No Match on Catch-Ups and No True-Ups

Photo by Katie Mollon (License)