This blog was updated 12.19.2025 with enhanced examples.

Background

Effective January 1, 2026, catch-up eligible participants who are High Earners must make catch-up contributions on the Roth basis. The industry has been using the term Highly Paid Individuals, so we will use both terms for the sake of clarity and consistency with other published articles. Before delving into the details on how to administer this new Roth mandate, let’s review the compensation thresholds that make a participant a High Earner and a contribution a catch-up contribution.

IRS Publishes New Limits

The IRS published the limits applicable to retirement plans in 2026 on Notice 2025-67, as published in our previous blog From the Diamond to the Desk: 2026 Retirement Plan Limits Step Up to the Plate. 2026 contribution limit changes that affect the administration of the Roth catch-up mandate include the 402(g) deferral limit increase to $24,500 and the catch-up limit increase to $8,000. Catch-up eligible participants can contribute a maximum of $24,500 + $8,000 = $32,500 or if they turn ages 60-63 during the plan year, a maximum of $24,500 + $11,250 = $35,750.

High Earner/Highly Paid Individual Limits

The threshold for determining who is a High Earner, or Highly Paid Individual, for purposes of the Roth Catch-up Mandate that will be effective on January 1, 2026 also increased. Specifically, catch-up eligible High Earners who show more than $150,000 in FICA wages on their 2025 Form W-2 must contribute 2026 catch-up contributions of $8,000 or 2026 super catch-up contributions of $11,250 on the Roth basis.

Affirmative Election vs. Deemed Election

Affirmative Elections

Employers and recordkeepers or third party administrators should collaborate to provide participants with deferral election forms that match what the payroll software can process. The types of deferral elections typically offered by payroll companies include:

- A tentative election: Catch-up contributions are withheld from the beginning of the year, in anticipation of the participant’s total contributions exceeding the 402(g) limit ($24,500 in 2026) or other relevant plan limits.

- If the participant terminates employment or otherwise does not meet the legislative threshold that triggers a catch-up, the misclassified catch-up money is recharacterized as a regular contribution. The contribution can keep the original source (pre-tax or Roth), such that only the catch-up classification needs to be removed.

- Plan sponsors must understand that the tentative election method is a practical approach. By definition, catch-up contributions cannot exist before a limit is reached, as applicable: the 402(g) limit, the plan limit, or the ADP test limit.

- If contributions originally designated as catch-ups are not recharacterized as regular contributions for a participant who leaves mid-year, the census information used for the ADP test could be inaccurate. The ADP test is not affected by contribution sources, so the Roth and pre-tax code of the original remittance remains the same, only the catch-up designation needs to be removed.

- If the plan does not match catch-up contributions, an employee who leaves mid-year is owed match contributions for the catch-up amounts that must be recharacterized.

- A spill election: Participants make an election in the form of percentages or dollars and contributions are designated as regular contributions until the 402(g) limit or the plan limit is achieved, and then they are designated as catch-up contributions.

- A separate election specifically for catch-up contributions that kicks in when the 402(g) limit or the plan limit, if lower, is achieved.

Deemed Elections

If the affirmative election is not compliant, or the participant was automatically enrolled and there is no affirmative election, the final regulations allow plan sponsors to “deem” (i.e., automatically convert) a high-paid participant’s pre-tax catch-up election to Roth, without such participant’s consent and regardless of whether the plan uses a separate, tentative, or spill election.

If the participant’s affirmative election is compliant with the Roth catch-up mandate, implementing a deemed election is not necessary for that person.

Deemed elections are especially useful when participant elections only choose deferrals of a percentage of each payroll or dollar amount per payroll up to $32,500 or $35,725, but the chosen contributions do not include enough Roth dollars to comply with the Roth catch-up mandate. To facilitate the administration of the Roth mandate, the Regulations permit plan sponsors to use two Deemed Election Methods to automatically switch participant contributions to the Roth basis either under:

- Method 1: Once the participant’s total deferrals, including pre-tax and Roth contributions, get to the 402(g) limit, which is $24,500 for 2026, or

- Method 2: Switch the deferrals to Roth once the pre-tax contributions get to the 402(g) limit. Method 2 allows all Roth contributions made during the year to count towards the Roth catch-up mandate.

Depending on the plan sponsor’s demographics, the burden of requesting affirmative elections from all catch-up eligible participants could exceed the burden of sending a deemed election notice, but every plan sponsor must make its own decision based on their participant demographics, the capabilities of their payroll providers, the expertise of their plan personnel, and what works for their company.

Our previous blog, Catch the Catch-Up Final Regulations Before They Catch You Off-Guard explains all the complexities of administering the Roth catch-up mandate in accordance with the Final Regulations. Please refer to that blog for a full discussion of the rules.

In response to requests from our audit clients, this blog will provide examples of the Deemed Elections Methods 1 and 2, for participants contributing to Roth and pre-tax sources throughout the year, as well as for participants contributing only pre-tax, or only Roth contributions.

Example 1: Comparison of Methods 1 and 2

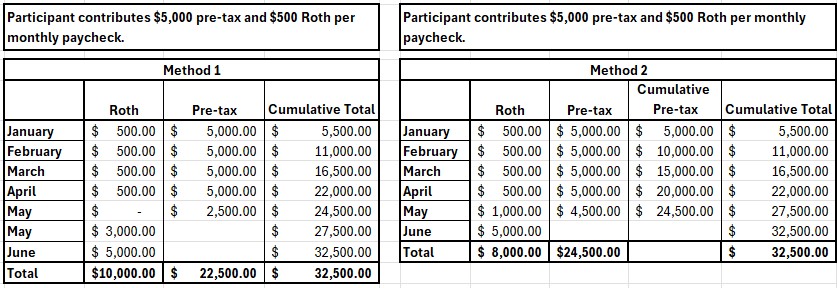

The following example demonstrates Deemed Election Methods 1 and 2 side by side for a participant who contributes $500 Roth dollars and $5,000 pre-tax dollars from each monthly paycheck, a non-compliant affirmative election:

Method 1 disregards Roth deferral contributions made before achieving the 402(g) limit ($24,500 for 2026). Once the participant’s total employee contributions equal the 401(a)(30) limit, which is the employer-based individual 402(g) limit, or $24,500 for 2026, the plan sponsor switches all employee contributions to the Roth basis. Please note that Method 1 prevents this participant from contributing the full 2026 402(g) limit of $24,500 on a pre-tax basis, while also forcing the participant to contribute more than $8,000 in taxable Roth contributions. On the other hand, Method 2 allows a Roth-catch-up eligible participant who wants to maximize pre-tax deferrals to do so, by giving the person credit for Roth deferrals made since the beginning of the year.

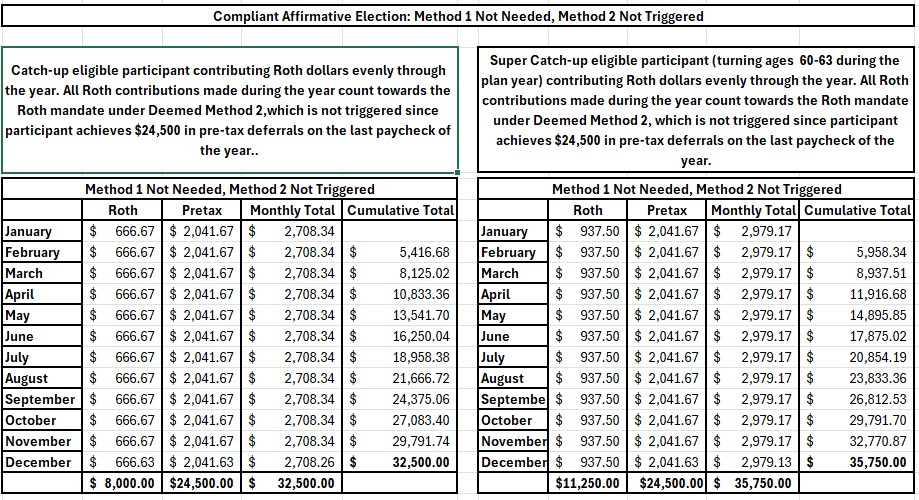

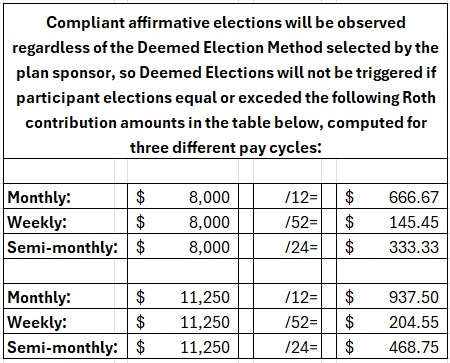

If the Roth catch-up eligible participant had made a compliant affirmative election requesting minimum Roth contributions of $666.67 per month or $937.50 for a super-catchup eligible participant, then there would be no reason for the plan sponsor to use either one of the Deemed Election Methods, since the participant will comply with the mandate using the affirmative election submitted.

Example 2: Method 1 Should Not Have Been Used

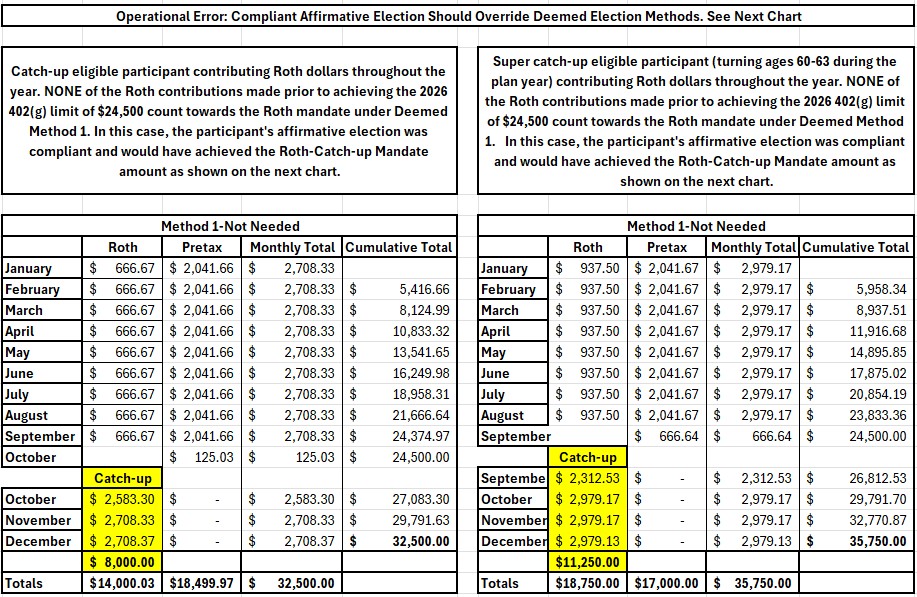

The following example illustrates an operational error involving an employer that uses Deemed Election Method 1 to increase a participant’s Roth contributions beyond the required $8,000 when the participant’s affirmative election would have resulted in compliant contributions:

Deemed Election Method 1 increased the participant’s tax liability unnecessarily by preventing the participant from contributing the 2026 maximum limit of $24,500 on a pre-tax basis, when the participant’s affirmative election would have resulted in compliant contributions that should not trigger Methods 1 or 2, as shown in the following chart:

Example 3: Method 1 Not Needed, Method 2 Not Triggered

Example 4: No Difference Between Methods 1 and 2

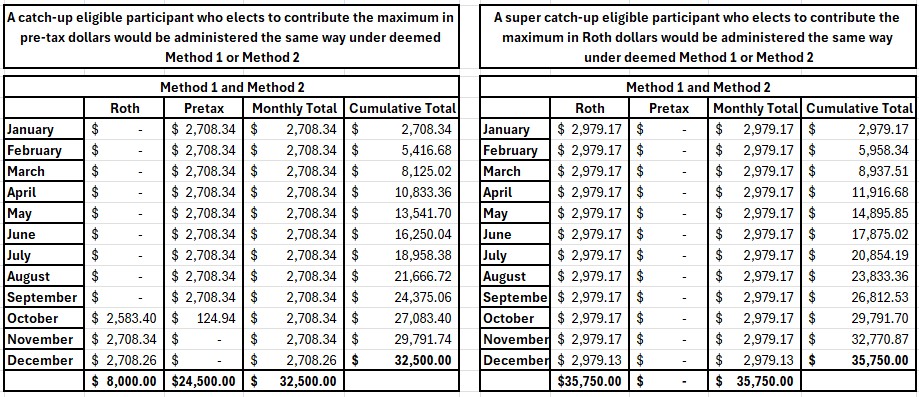

Participants who have made an election to contribute the maximum 402(g) limit plus catch-up completely in pre-tax dollars or completely in Roth dollars would be treated the same under Method 1 or Method 2. If the participant does not wish to make Roth catch-up contributions, the participant would make an affirmative election to opt-out of a catch-up contribution. The deemed-election methodology is presented below, assuming the participant does not opt out of the catch-up contribution:

The deemed election method makes a choice to comply with the Roth catch-up mandate on behalf of the participant, subject to the distribution of a notice, rather than requiring affirmative elections from every participant. Plan sponsors who plan to use the deemed election methods should contact their third-party administrators and recordkeepers before year-end to ensure that the proper notices are distributed.

Assume Nothing

Plan sponsors should collaborate with their payroll providers to understand their responsibilities with respect to the identification of Roth Catch-up Eligible Participants and to switching contributions to Roth when a deemed election method is needed. Plan sponsors may be responsible for coding contributions as Roth contributions on the payroll once the threshold is achieved under Method 1 or Method 2. The process may not be automatic. Assuming that service providers will take care of administering the Roth catch-up mandate will almost certainly land employers in correction-land. Please refer to our previous blog Catch the Catch-Up Final Regulations Before They Catch You Off-Guard for a discussion of the available corrections.

An Ounce of Prevention is Better than a Pound of Cure

Preventing errors by preparing for the accurate implementation of the Roth Catch-up Mandate by taking the following steps will be an investment that plan sponsors won’t regret:

- Before each year ends, run a report to identify most Roth Catch-up Eligible Participants. Verify participants who were on the fence on the first week of January.

- Ensure that Roth Catch-Up Eligible participants are accurately coded in the payroll.

- Understand who is responsible for switching contributions to Roth under the Deemed Election Methods.

- At year end, run a payroll report in Excel and isolate the Roth Catch-up Eligible Participants. The outliars will be easy to spot.

- Determine if a correction is necessary before you issue W-2s. There is no pre-approved correction involving amended W-2s for Roth Catch-up Mandate corrections at this time.

- Instruct the recordkeeper to move funds from the pre-tax to the Roth source, without issuing a Form 1099-R, for participants for whom you changed the W-2 to reflect the correct deposits.

- If W-2s have already been issued, instruct the recordkeeper to complete an in-plan Roth rollover for the correction amount needed.

- Errors up to $250 do not need to be corrected.

When the Idea is Easier than its Execution…

The Roth Catch-up Mandate is easier to understand than to implement. Without a doubt, the idea is easier than its execution, so it is imperative for plan sponsors to be pro-active in collaborating with the service providers to understand who is responsible for doing what. If all else fails, there is a correction for that, but proper planning will yield a much better outcome…..That was easy!….and aren’t we all about improving retirement-related outcomes?