In Summary

-

Mandatory Roth Contributions for High Earners: Effective January 1, 2026, “High Earners” (defined as participants with prior-year FICA wages exceeding $150,000) are required to make all catch-up contributions—including the new “Super Catch-Up” for participants aged 60–63—on a Roth (after-tax) basis.

-

Exclusions and Plan Limitations: The mandate strictly applies to employees with W-2 FICA wages, meaning self-employed partners and sole proprietors are exempt; furthermore, if a retirement plan does not offer a Roth feature, High Earners are effectively prohibited from making any catch-up contributions at all.

-

Compliance and Correction Methods: Plan sponsors may utilize “deemed elections” to automatically switch contributions to Roth once limits are reached, and any inadvertent pre-tax errors can be corrected via specific W-2 correction methods or In-Plan Roth Rollovers.

________________________________________________________________________________________________

*This blog was updated on 11.20.2025 to reflect the new IRS limits applicable to retirement plans for 2026.

The New Mandatory Roth Catch-Up Rules

The New Mandatory Roth Catch-Up Rules

Section 603 of the Setting Every Community Up for Retirement Enhancement Act 2.0 (SECURE Act 2.0) added Internal Revenue Code (IRC) Section 404(v)(7) to require catch-up eligible High Earners to make catch-up contributions to their 401(k), 403(b), and 457(b) plans on a Roth basis, effective January 1, 2026. However, the Final Regulations corroborate that ANY Roth contributions made by a participant throughout the year can satisfy the Roth catch-up mandate amount of $8,000*, at the election of the Employer.

The Final Regulations issued in September of 2025 are effective as of January 1, 2027, but the Roth catch-up mandate continues to be effective as of January 1, 2026, such that good faith compliance with the rules is expected between January 1, 2026 and December 31, 2026.

High Earners Defined

IRC Section 414(v)(7)(A) specifies that mandatory Roth catch-up contributions apply to catch-up eligible participants whose FICA wages for the preceding calendar year from the employer sponsoring the plan exceeded the applicable limit, as indexed. In this blog, we have identified the affected plan participants as High Earners. Others in the industry call them Highly Paid Individuals (HPIs). Their title is not as important as understanding that they are not the same group of people as the Highly Compensated Employees (HCEs), as explained later in this article.

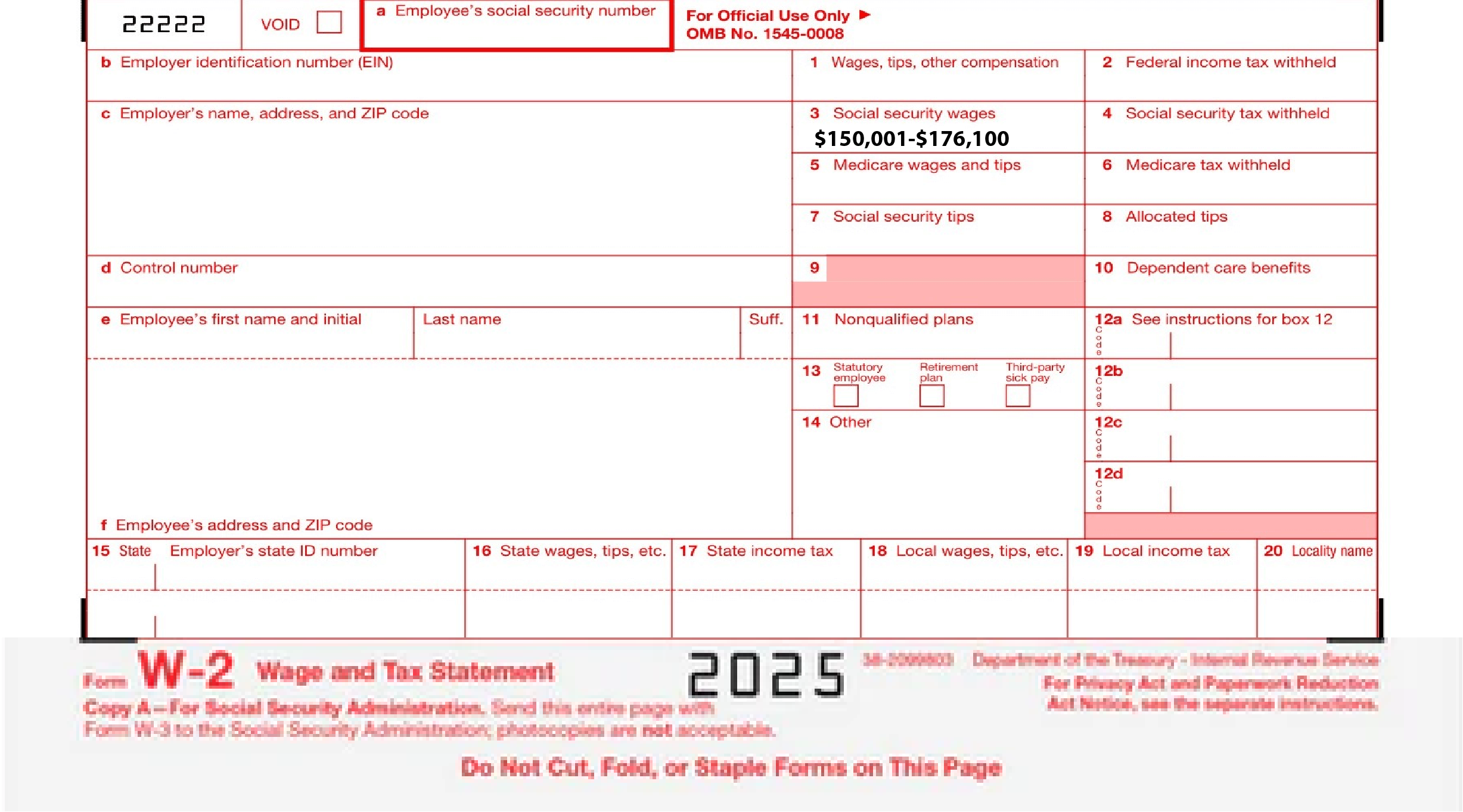

The 2026 High Earners will be identified using FICA wages as defined in IRC section 3121(a), which are reported on Box 3 of the 2025 Form W-2. If a plan participant’s 2025 FICA wages are greater than $150,000, 2026 catch-up contributions must be made on the Roth basis. Alternatively, at the employer’s election, any Roth contributions made during the year can be included to determine whether the $8,000* mandate has been satisfied.

The Final Regulations clarify that if a participant’s W-2 is later amended and the participant is no longer a High Earner, the deemed Roth election does not need to be revoked.

Participants who do not receive FICA wages, such as partners who only have self-employment income reported on a Form K-1, or sole proprietors who file a Schedule C are not subject to the Roth catch-up mandate.

Super Catch-Up for Participants age 60, 61, 62, 63

For taxable years beginning after December 31, 2024, section 109 of the SECURE 2.0 Act amended IRC section 414(v)(2) to increase the applicable dollar catch-up limit for participants who attain age 60, 61, 62, or 63 during the taxable year (the Super Catch-Up). The increased applicable dollar catch-up limit for 401(k), 403(b), and 457(b) governmental plans is 150 percent of the current catch-up limit. Using the 2025 catch-up limit of $8,000*, the Super Catch-Up amount available to participants who attain ages 60 to 63 during a plan year amounts to $11,250 for 2025 and 2026.

The higher limit (super catch-up) for participants attaining age 60 through 63 during a plan year is an optional plan provision. However, every plan within the same controlled group must make it available to eligible participants, except union members and nonresident aliens can be excluded. Amendments to add the super catch-up are part of the SECURE amendments due December 31, 2026.

Participants who attain ages 60 to 63 during a plan year are subject to the Roth Catch-Up Mandate for their $11,250 super catch-up contributions.

403(b) Special Catch-up and Governmental 457(b) Plan Special Catchup

For details on the mechanics of the 403(b) Special Catch-up and the 457(b) Special Catch-Up, please refer to our previous blogs: How to Compute the 15-Year Special Catch-Up for 403(b) Plans and Special Section 457(b) Catchup for Government Plans

The 403(b) Special Catch-Up optional opportunity for employees with at least 15 years of service is not subject to the Roth catch-up mandate for High Earners. In fact, contributions in excess of the 402(g) limit are attributed to the 403(b) Special Catch-Up first, and then to the 414(v) catch-up, including the increased limit for participants turning 60,61,62, or 63. The Final Regulations specifically state that:

“§ 1.403(b)-4(c)(3)(iv) provides that any catch-up amount contributed by an employee who is eligible for both types of catch-up contributions is treated first as a special section 403(b) catch-up contribution and then as a catch-up contribution under section 414(v). Accordingly, the special section 403(b) catch-up contributions are not subject to section 414(v), including the requirement under section 414(v)(7) that certain catch-up contributions be designated Roth contributions.”

A consistent application of the above concept would lead us to conclude that the special catch-up under IRC section 457(b)(3) permitted for the last three taxable years ending before an individual attains normal retirement age would also not be subject to the Roth catch-up mandate for High Earners.

If the plan does not offer a Roth feature, High Earners are precluded from making catch-up contributions, but other catch-up eligible participants can make catch-up contributions. The Regulations reiterate that in a plan that does not have a Roth feature, the maximum catch-up with respect to the High Earners is zero. The High Earners in this case are treated as if they were not catch-up-eligible.

Highly Compensated Employees (HCEs) are not the same as High Earners

Highly Compensated Employees (HCEs) are not the same as High Earners and are not the same as Key Employees.

- The High Earner Determination is used for the Roth Catch-up Mandate

- The HCE determination is used for the ADP discrimination test.

- The Key Employee determination is used for the Top-Heavy Test, which is beyond the scope of this article.

Highly Compensated Employees Defined: For the 2025 plan year, an employee who earns more than $155,000 in 2024 is an HCE. For the 2026 plan year, an employee who earns more than $160,000 in 2025 is an HCE.

If stated in the document, employers may limit HCE’s based upon compensation to the top 20% of the highest paid employees. This provision does not remove any owners from the HCE determination. Specifically:

- An employee is considered to be an HCE if he or she owns more than 5% of the company sponsoring the plan at any time during the current or previous plan year, regardless of compensation.

- Ownership is determined at any time during the current or prior year. Therefore, even if an HCE reduces their ownership below the 5% threshold, they continue to be considered an HCEs through the end of the following plan year.

Using the applicable W-2 wages to identify High Earners and HCEs reveals that High Earners (FICA wages $150,000* in 2025 for 2026 High Earner determination) are not necessarily HCEs ($160,000 in 2025 for 2026 HCE determination), but all HCEs identified by virtue of their wages are High Earners. However, some HCEs do not have FICA wages, so they can never be High Earners.

Self-employed individuals do not have FICA wages and do not get a W-2, so they will never be High Earners, even if their compensation exceeds $150,000*. Counterintuitively, partners in a partnership that only shows self-employment income on their Form K-1, self-employed individuals who file a Schedule C with their Form 1040, and certain government employees are not subject to the Roth catch-up mandate, unlike their employees who likely make less money than they do, but still enough to be High Earners.

To boot, plans that do not offer a Roth feature would effectively prevent High Earners from making a catch-up contribution, while their self-employed bosses enjoy the higher limits on a pre-tax basis. Plans that do not offer a Roth feature could consider excluding self-employed individuals who make more than $150,000* from the catch-up feature to be sure that there is no benefits, rights and features violation. The exclusion would treat High Earners and self-employed participants who make more than $150,000* equally, in a plan that does not offer a Roth feature.

Conversely, the Final Regulations state that there is no benefits, rights, and features violation when all participants in a plan that does not offer a Roth feature receive a W-2, and NHCE High Earners are prevented from making pre-tax catch-up contributions, while their catch-up eligible NHCE colleagues who are not High Earners can make pre-tax catch-up contributions. If everyone gets a W-2 and the plan does not offer a Roth feature, the maximum catch-up available to the High Earners is zero, as if they were not catch-up eligible, and there is no benefits, rights, or features violation.

Employer Sponsoring the Plan Defined

The final regulations provide that the term “employer sponsoring the plan” can refer to the specific common law employer for which the participant works, or in cases where the common law employer is a member of a controlled group that uses a common paymaster, the plan may provide that the employee’s common law employer is aggregated with one or more other specified employers in that group of employers to treat the aggregated employers as a single employer sponsoring the plan for purposes of determining who is a High Earner. In that case, the employee’s FICA wages from the common law employer and from the one or more other employers that are aggregated with the common law employer are treated as FICA wages from the employer sponsoring the plan. Aggregation of wages in situations involving controlled groups and common paymasters is optional.

As we explained previously, FICA wages on Box 3 of a participant’s W-2 determine whether a participant is a High Earner subject to the Roth Catch-up mandate. This applies even in cases of an asset purchase where the successor employer files a Form W-2 for the calendar year of the asset purchase. As a result, a plan that is sponsored by the successor employer (or an entity that is aggregated with the successor employer in accordance with final regulation § 1.414(v)-2(b)(4)(ii) or (iii)) may provide that all of the wages reported in Box 3 of the Form W-2 are treated as wages from the employer sponsoring the plan for purposes of determining applicability of the Roth catch-up requirement.

In the case of multiemployer plans, multiple employer plans (MEPs), and pooled employer plans (PEPs), a catch-up eligible participant’s FICA wages for the preceding calendar year from one participating employer are not aggregated with the participant’s FICA wages for the preceding calendar year from another participating employer in the plan for purposes of determining whether the participant’s FICA wages for that year exceeded the Roth catch-up wage threshold. In the context of the Roth catch-up requirement for multiemployer plans, the signatory employer is the common law employer that is the source of the participant’s FICA wages and contributions to the multiemployer plan (but the plan may provide for aggregation of FICA wages from certain related employers as described earlier in this section).

All Employers in a Controlled Group must permit catch-up contributions and/or super catch-up contributions. High Earners are subject to the Roth catch-up mandate for both increased limits.

Deemed Elections vs. Affirmative Elections

Plans may get affirmative elections from High Earners indicating whether they want amounts in excess of any applicable limit (402(g), ADP test, plan limit) to be a designated Roth contribution. A participant can choose to make Roth deferrals throughout the year count towards the $8,000* Roth catch-up mandate, if the plan permits earlier Roth contributions to count towards the requirement. Alternatively, the plan may deem that participants who exceed an applicable limit have elected to make designated Roth contributions, as long as they have an effective opportunity to change or opt-out of the deemed election.

Similar to the process for automatic enrollment plans, providing an effective opportunity means that the participants must be informed that catch-up contributions (based on the applicable plan limit) will be made on a Roth basis even if a participant has not made a Roth contribution election, along with instructions on how to request a change to the deemed election. The Final Regulations do not provide a specific mechanism for the distribution of this notice, but it is likely a best practice to include the notice with annual notices such as a safe harbor notice, a QDIA notice, and/or eligibility notices provided to newly eligible participants.

The deemed Roth election continues to apply even if the Form W-2 is later amended and the participant’s FICA wages no longer exceed the Roth catch-up threshold.

The Employer can choose one of two options regarding the timing of the deemed Roth election:

- Method 1: Once the participant’s total deferrals, including pre-tax and Roth contributions, get to the 402(g) limit, which is $24,500 for 2026, or

- Method 2: Switch the deferrals to Roth once the pre-tax contributions get to the 402(g) limit. Method 2 allows all Roth contributions made during the year to count towards the Roth catch-up mandate.

Following are two illustrations of Method 1 and Method 2:

Method 1 |

||||

| Roth | Pre-Tax | Monthly Total | Cumulative Total | |

| January | $666.67 | $2,041.65 | $2,708.33 | |

| February | $666.67 | $2,041.66 | $2,708.33 | $5,146.66 |

| March | $666.67 | $2,041.66 | $2,708.33 | $8,124.99 |

| April | $666.67 | $2,041.66 | $2,708.33 | $10,833.32 |

| May | $666.67 | $2,041.66 | $2,708.33 | $13,541.65 |

| June | $666.67 | $2,041.66 | $2,708.33 | $16,249.98 |

| July | $666.67 | $2,041.66 | $2,708.33 | $18,958.31 |

| August | $666.67 | $2,041.66 | $2,708.33 | $21,666.64 |

| September | $666.67 | $2,041.66 | $2,708.33 | $24,374.97 |

| October | $125.03 | $125.03 | $24,500.00 | |

| Catch-up | ||||

| October | $2,583.30 | $0 | $2,583.30 | $27,083.30 |

| November | $2,708.33 | $0 | $2,708.33 | $29,791.63 |

| December | $2,708.37 | $0 | $2,708.37 | $32,500.00 |

| $8,000.00 | $32,500.00 | |||

The example above illustrates the appropriate mechanics for Deemed Election Method 1, but this affirmative election will result in $8,000 of Roth catch-up contributions and should not have triggered a Deemed Election Method. See the chart below to see why an affirmative election in this amount would be compliant with the Roth catch-up mandate.

Method 2 |

||||

| Roth | Pre-Tax | Monthly Total | Cumulative Total |

|

| January | $666.67 | $2,041.67 | $2,708.34 | |

| February | $666.67 | $2,041.67 | $2,708.34 | $5,416.68 |

| March | $666.67 | $2,041.67 | $2,708.34 | $8,125.02 |

| April | $666.67 | $2,041.67 | $2,708.34 | $10,833.36 |

| May | $666.67 | $2,041.67 | $2,708.34 | $13,541.70 |

| June | $666.67 | $2,041.67 | $2,708.34 | $16,250.04 |

| July | $666.67 | $2,041.67 | $2,708.34 | $18,958.38 |

| August | $666.67 | $2,041.67 | $2,708.34 | $21,666.72 |

| September | $666.67 | $2,041.67 | $2,708.34 | $24,375.06 |

| October | $666.67 | $2,041.67 | $2,708.34 | $27,083.40 |

| November | $666.67 | $2,041.67 | $2,708.34 | $29,791.74 |

| December | $666.63 | $2,041.63 | $2,708.26 | $32,500.00 |

| $8,000.00 | $24,500.00 | $32,500.00 | ||

Compliant affirmative elections will e observed regardless of the Deemed Election Method selected by the plan sponsor, so Deemed Elections will not be triggered if participant elections equal or exceeded the following Roth contribution amounts in the table below, computed for three different pay cycles:

| Monthly | $8,000 | /12 = | $666.67 |

| Weekly | $8,000 | /52 = | $145.45 |

| Semi-Monthly | $8,000 | /24 = | $333.33 |

| Monthly | $11,250 | /12 = | $937.50 |

| Weekly | $11,250 | /52 = | $204.55 |

| Semi-Monthly | $11,250 | /24 = | $468.75 |

Although designated Roth contributions made through the plan year can be attributable to the Roth catch-up mandate of $8,000*, they are not technically a catch-up contribution if they are contributed prior to the participant reaching the 402(g) limit or the plan limit, if lower. If your payroll provider suggests labeling participant contributions as a catch-up starting with the first paycheck of the year, please refer to our previous blog explaining why this incorrect practice leads to operational errors: Catch-Up Contributions Must Exceed Some Limit.

For a plan to apply a deemed Roth catch-up election to a participant, the deemed Roth catch-up election must be set forth in the plan document. The deadline to amend plans for the provisions of Section 603 of the SECURE 2.0 Act is December 31, 2026. Collectively bargained plans and governmental 457(b) plans have a later deadline.

Available Corrections When Pre-Tax Catch-Ups Must be Recharacterized

Roth catch-ups could consist of:

- Deferral contributions in excess of the 402(g) limit: $24,500 for 2026*

- Contributions in excess of the amount permitted by the ADP test

Sometimes, catch-up eligible High Earner participant contributions are made on the pre-tax basis by mistake or because at the time of the contribution, the discrimination test has not been completed. When a plan fails the Actual Deferral Percentage (ADP) discrimination test, High Earners who are also HCEs may have to recharacterize some of their pre-tax deferrals as Roth catch-ups because of the failed ADP test.

Safe Harbor Plans and 403(b) Plans are not subject to the ADP test. For details regarding the available safe-harbor formulas and the mechanics of the ADP test, please refer to our previous blog: What are the Available Safe Harbor Plan Formulas?

Form W-2 Correction Method

If the Employer has not yet issued the participant’s W-2, a participant’s pre-tax catch-up contribution that was required to be a designated Roth contribution can be reported as a Roth contribution on the participant’s W-2 for the year of the deferral, as if the contribution had been correctly made as a Roth contribution. Additionally, the Recordkeeper must transfer the funds in the participant’s retirement account from the pre-tax source to the Roth source.

When using the W-2 Correction Method, the Employer must make sure that the Recordkeeper will not issue a Form 1099R for the reclassification from a pre-tax to a Roth source if the Form W-2 was updated. The Recordkeepers’ systems are often programmed to issue a Form 1099-R when funds are transferred from a pre-tax to a Roth source, so the utmost care must be taken to ensure the participant does not inadvertently end up with double taxation if the Employer updates the W-2 and the recordkeeper sends a Form 1099-R when the assets are reclassified to the Roth source.

Under the Form W-2 Correction Method, the contribution (not adjusted for allocable gain or loss) will be includible in the participant’s gross income for the year of the deferral as if the contribution had been correctly made as a designated Roth contribution.

The W-2 Correction Method is not permitted if the participant’s Form W-2 for that year has already been filed or furnished to the participant. An amended W-2 is not an option, but there is another solution that eliminates the potential for an inadvertent double taxation error, the In-Plan Roth Rollover Correction Method.

The In-Plan Roth Rollover Correction Method

Using the In-Plan Roth Rollover Correction Method, a plan would directly roll over the elective deferral (adjusted for allocable gain or loss) from the participant’s pre-tax account to the participant’s in-plan rollover Roth account and report the amount of the in-plan Roth rollover on Form 1099-R (Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.) for the year of rollover. Thus, the amount directly rolled over to the participant’s in plan rollover Roth account would be the same as the amount reported on Form 1099-R, and the contribution (adjusted for allocable gain or loss) would be includible in the participant’s gross income for the year of the rollover.

A plan may use the in-plan Roth rollover correction method even if the plan does not permit participants to elect in-plan Roth rollovers under section 402A(c)(4)(E).

Plans must apply the same correction method for similarly situated participants. For example, a plan may provide for correction using the Form W-2 correction method for all participants for whom the Forms W-2 for that year have not been filed or furnished and for correction using the in-plan Roth rollover correction method for all other participants.

For a plan to be eligible to use either of the correction methods above, the plan sponsor or plan administrator must have in place practices and procedures designed to result in compliance with the Roth catch-up mandate at the time the elective deferral is made.

The Five-Year Holding Period Disparity Between Correction Methods

Pre-tax amounts transferred to a Roth source pursuant to the Form W-2 correction are subject to the 5-taxable-year-period that began with the first taxable year in which the individual made a designated Roth contribution under the applicable retirement plan.

On the other hand, consistent with the rules that require each in-plan Roth rollover to have its own 5-year holding period, pre-tax amounts reclassified as a Roth contribution using the in-plan Roth rollover correction method have their own 5-year holding period. As such, the Final Regulations provide that “any balances distributed within the 5-year taxable period beginning on January 1 of the year in which the in-plan Roth rollover correction is made will be subject to a 10% additional tax under IRC section 72(t) unless an exception applies under IRC section 72(t)(2).” Specifically, if the five-year holding period has not been met, the earnings portion of distributions from designated Roth accounts taken after age 59 ½ is subject to tax but not subject to the 10% penalty.

For details on how the 5-year holding period works for designated Roth accounts in retirement plans, (which differ from the Roth IRA rules), please refer to our previous blog on designated Roth accounts: 55 Things You Should Know About 401(k)/403(b)/457(b) Designated Roth Accounts.

The disparity in the application of the 5-year holding period between the two correction methods achieves administrative consistency with existing rules, but inconsistency between the tax treatment of similarly situated participants. Typically, I am an advocate of administrative simplicity as a valid priority, but not in this case. I would have allowed reclassifications done through the in-plan rollover correction method to be grouped with the existing Roth-source, as if the contributions had been correctly deposited as designated Roth contributions. Although the in-plan rollover correction method is easier, in my opinion, the W-2 correction method is more fair, even if it requires collaboration with the recordkeeper to reclassify the balances so that they agree with the updated W-2. Nobody said the rules have to be fair.

Refund/Distribution Method

If a participant does not want to make Roth catch-up contributions, or the deadline for the above two corrections has passed, the plan will distribute pre-tax deferrals in excess of the applicable limits plus earnings to the plan participant, and the Recordkeeper will issue a Form 1099-R.

Plan sponsors must not assume that the correction process will happen automatically. It is imperative for Employers to read their contracts with their various service providers, such as their third-party administrators or bundled recordkeepers, to understand the extent of their involvement that is necessary for the corrections to be processed.

Deadline to Correct IRC Section 414(v)(7) Roth Catch-up Failures

Roth Catch-up failures under IRC 414(v)(7) must be corrected by the end of the plan year following the plan year in which the failure arose. However, Roth catch-up failures are associated with the failure to comply with one of three applicable limits that have their own correction deadlines as follows:

| Sections 402(g)/401(a)(30) Limit | April 15-Beware of punitive double taxation

(Participant pays tax in the year of the excess AND the year of correction if not distributed timely) |

| ADP Testing Failures | 2 ½ months after the plan year end (March 15) |

| Automatic Enrollment Plan ADP Failures | 6 months after the plan year end (June 30)

(Employer pays Section 4979 10% Excise Tax if not distributed timely) |

| Catch-up Recharacterization as Roth | December 31 (last day of the following plan year)

Failure to correct is a plan disqualification error For now, refund is required if deadline is missed. |

Correction Not Required in Certain Circumstances

As a general matter, in order to remain qualified, any failure to meet the qualification requirements must be corrected even if all applicable statutes of limitations on assessment for the year in which the failure occurred have closed. However, the Final Regulations list two instances in which a failure to comply with the Roth catch-up mandate does not need to be corrected:

- First, correction is not required if the amount of the pre-tax elective deferral that was required to be a designated Roth contribution does not exceed $250. For purposes of applying this $250 threshold, earnings and losses on the pre-tax elective deferral are not taken into account.

- Second, correction is not required if the participant became subject to the Roth catch-up mandate as a result of an amended W-2.

The Answer is NO!

If reading all these rules has you thinking about eliminating Roth provisions or catch-ups from your plan, I don’t blame you, so here are some of the most common considerations to which the answer is NO!

- Plans do not have to offer a catch-up provision.

- Plans do not have to offer a Roth option.

- Plans cannot require that ALL catch-up contributions be ROTH contributions.

- Plans cannot make Roth available only for catch-up contributions.

- Plans cannot make Roth available only to catch-up eligible participants.

- Catch-up eligible participants who are not High Earners are not precluded from making catch-up contributions in a plan that does not have a Roth feature.

Rothification is Upon Us

In the end, 95% of all plans offer both Roth and catch-up so you will likely end up enduring the implementation of these rules with the rest of us. The mandatory Rothification that our Delaware Senator Roth never expected would become part of his legacy is upon us, motivated by immediate tax revenue, but ultimately beneficial for those forced to Rothify.

For reading much lighter than the mandatory Roth catch-up for High Earners, please refer to our melancholic blog about our Delaware Senator Roth and his legacy.