In Summary

- Roth’s Vision: Senator Roth’s legacy continues through tax-free retirement innovation, as his creation of the Roth IRA in 1997 transformed retirement savings and inspired later Roth-style accounts like Roth 401(k), 403(b), and 457(b).

- Mandatory Roths Era: Rothification marks a shift toward mandatory after-tax contributions, beginning in 2026 when High Earners must make catch-up contributions to their workplace retirement plans on a Roth basis under SECURE 2.0.

- After-Tax Now, Gain Later: A fiscal strategy with long-term implications for federal revenue, Roth contributions eliminate short-term tax deductions but promise future tax-free growth, potentially boosting government tax collections by $1 trillion over the next decade.

_______________________________________________________________________

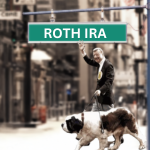

Being from Delaware, I remember Senator Roth, the lone U.S. Representative from Delaware, and his two giant St. Bernards walking down Market Street, greeting all his constituents. Who knew that this affable man would leave behind a legacy that will benefit millions of people for generations to come? At the age of 76, he created the Roth IRA, an individual retirement plan that can be set up with post-tax dollars, offering tax-free withdrawals. Senator Roth was the last Republican to serve as a U.S. Senator from Delaware, and he left a big legacy: Roth IRAs were created as part of the Taxpayer Relief Act of 1997, which was signed into law by then-President Bill Clinton. In the year 2022, contributions to Roth IRAs outpaced contributions to traditional IRAs. When Senator Roth died in 2023, more than $14 trillion in Roth IRAs were owned by 31.9 million households, representing 24.3% of the U.S. population. But Roth alternatives did not stop there…

Being from Delaware, I remember Senator Roth, the lone U.S. Representative from Delaware, and his two giant St. Bernards walking down Market Street, greeting all his constituents. Who knew that this affable man would leave behind a legacy that will benefit millions of people for generations to come? At the age of 76, he created the Roth IRA, an individual retirement plan that can be set up with post-tax dollars, offering tax-free withdrawals. Senator Roth was the last Republican to serve as a U.S. Senator from Delaware, and he left a big legacy: Roth IRAs were created as part of the Taxpayer Relief Act of 1997, which was signed into law by then-President Bill Clinton. In the year 2022, contributions to Roth IRAs outpaced contributions to traditional IRAs. When Senator Roth died in 2023, more than $14 trillion in Roth IRAs were owned by 31.9 million households, representing 24.3% of the U.S. population. But Roth alternatives did not stop there…

If Senator Roth Only Knew that Rothification Would Become a Word

Three years after he died at the age of 82, Roth 401(k), 403(b), and 457(b) contributions became available, in 2006. Starting in 2010, all IRA owners and participants in 401(k), 403(b), and governmental 457(b) plans became eligible to convert their traditional IRA and pre-tax retirement plan funds to Roth dollars.

Until now, Roth contributions have been voluntary, but starting in 2026, 401(k), 403(b), and 457(b) plan participants who earned $145,000 or more in the previous year (High Earners), must make all catch-up contributions on a Roth basis in the current year, a requirement established by the Setting Every Community Up for Retirement Enhancement Act (SECURE 2.0). These compulsory Roth contributions could be just the beginning of a new Rothification era. Rothification refers to a policy shift requiring the use of Roth after-tax contributions or accounts. A fiscal conservative, Senator Roth’s goal was to create a vehicle that provided access to retirement savings without a short-term impact on the federal budget. Rothification would force that outcome, although I’m not sure that Senator Roth envisioned a mandate, rather than a choice.

No Short-Term Impact on the Federal Budget

Contributing with post-tax dollars means that unlike the regular pre-tax contribution, a Roth contribution does not provide an immediate tax benefit to the contributing individual. There is no tax deduction for contributions, but many years later, qualifying withdrawals are tax-free. Tax-free withdrawals means that the individual never pays tax on the appreciation of the investments held in the Roth account. Additionally, Roth accounts are not subject to the Required Minimum Distribution (RMD) Rules, further enhancing the value of the tax savings on the appreciation of the investments. Roth contributors are playing the long game, believing that the value of their investments will increase and hoping that the tax rate that would have applied to a taxable distribution would have been higher than the tax rate they paid on the dollars originally contributed. Some economists estimate that the federal government would collect an extra $1 trillion dollars in taxes over the next ten years through a Rothification mandate. The High Earner Roth Catch-Up provisions, discussed in our upcoming blog, may be just the beginning….