Posted By Maria T. Hurd, CPA, RPA

Coronavirus-Related Distributions are NOT “Eligible Rollover Distributions,” but They Can be Rolled Over: What Withholding Rate Applies?

Coronavirus-Related Distributions are NOT “Eligible Rollover Distributions,” but They Can be Rolled Over: What Withholding Rate Applies?

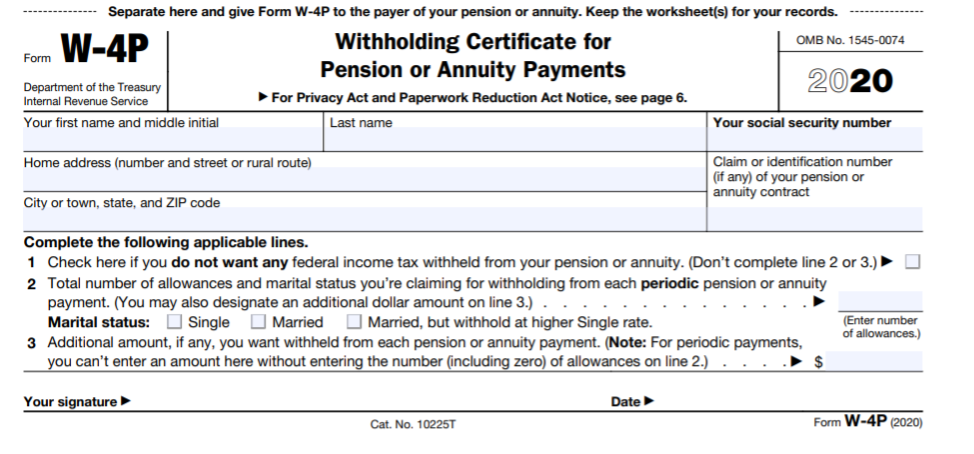

To address the novel Coronavirus, the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”) has created a novel type of distribution from retirement plans: the Coronavirus-Related Distribution (“CRD”). It is a “rolloverable” distribution that is NOT considered an Eligible Rollover Distribution for certain purposes, such as withholding. Eligible Rollover Distributions are subject to a mandatory 20% withholding, and distributions that are not eligible to be rolled over, such as hardship distributions and Required Minimum Distributions (RMDs) are subject to an optional 10% withholding. Although a CRD can be rolled over to another qualified plan or IRA directly or within three years of its distribution, it is only subject to the optional 10% withholding applicable to distributions that are not eligible to be rolled over. Since the withholding is optional, the participant can opt to have no withholding applied to the CRD by checking the box on line 1 of Form W-4P, copied below:

So far, this is simple enough, but a person can treat a distribution from a plan as a CRD even if the plan does not choose to offer CRDs. In these cases, is the withholding rate the plan applies to the distribution as optional as offering the distribution?

Is the Plan Responsible for the Tax Treatment of an Optional Plan Provision it Does Not Offer?

The CARES Act defines the CRD as a distribution to any INDIVIDUAL that meets the qualified individual (“QI”) definition. This means that the tax advantages of CRDs are available to individuals REGARDLESS of whether the employer chooses to offer CRDs through its retirement plan.

For example, an employer with remote-work capabilities that intends to continue its payroll may not feel inclined to offer CRDs and/or CRD repayments over three years just to benefit a handful of employees who may meet the lack-of-daycare or COVID-19 diagnosis-driven QI criteria. In that case, participants would be able to take a distribution only if they meet the plan’s regular distribution criteria: e.g., (a) rolled over sources; (b) age 59 ½; (c) hardship distributions as defined in the plan; or (d) termination from employment. At the individual level, the distribution would qualify for the favorable Coronavirus-Related Distribution tax and repayment treatment, but it seems the plan would have no obligation to follow special withholding rules for an optional plan provision that it does not offer or to obtain a self-certification that the participant is a QI, when issuing a regular plan distribution does not require it. But could a plan that does not offer CRDs choose to apply the reduced withholding rate and get a certification from the participant that he or she is a Qualified Individual? Industry organizations have requested additional guidance from the IRS regarding an employer’s ability to accommodate CRD withholding requests when the plan does not offer CRDs.

When the Plan Wants Business as Usual – No CRDs….

If the plan does not adopt CRD provisions, it would seem not only appropriate but required to withhold the mandatory 20% withholding for all otherwise eligible rollover distributions. The 20% withholding rate is required, and a participant may not elect to have no income tax withheld from eligible rollover distributions. No W-4P would be required unless the participant wants additional tax withheld.

This tax reporting situation is similar to a taxable lump sum distribution that the participant chooses to rollover to an IRA within 60 days of the distribution. The plan applies 20% withholding irrespective of the participant’s ability to complete a rollover at a later date. When the rollover occurs, the participant must find another source of cash to cover the withheld taxes or the withheld portion is taxable income to the participant.

Who prevails: the plan provisions or the Qualified Individual?

At the individual level, a Qualified Individual can treat the distribution as a CRD. Until these pandemic times, the law offered numerous benefits, rights and features options, and the employer chose the options that it made available to its participants – in that case, the plan prevailed. COVID-19 has changed some rules that had become second nature to our industry experts. When it comes to the taxation and repayment of CRDs, no matter what the plan says, the Qualified Individual prevails. The CARES Act has responded with novel new options for a novel new virus.