In Summary

- Pooled Employer Plans (PEPs) Defined: PEPs are a type of “open” multiple employer plan established by the SECURE Act allowing unrelated employers to share a single defined contribution plan, which is treated as one plan for both ERISA and IRS purposes, without the common interest requirement that applies to “closed” MEPs.

- The Pooled Plan Provider’s Role is Central: A Pooled Plan Provider (PPP), typically a financial institution or consulting firm, acts as the plan administrator and named fiduciary, responsible for key administrative duties, including compliance testing, but the participating employer still retains fiduciary duty for selecting and monitoring the PPP.

- Key PEP Requirements and Audit Considerations: A PEP must file a Form 5500 annually, including a list of participating employers, and is required to undergo an audit if it covers 100 or more participants; the plan’s complexity and the homogeneity of its provisions greatly affect the audit process and potential cost savings.

_______________________________________________________________________

Originally published in the Summer 2023 Issue of Delaware Banker (Delaware Bankers Association).

Originally published in the Summer 2023 Issue of Delaware Banker (Delaware Bankers Association).

Let’s Start With the Basics – What is a Pooled Employer Plan (PEP)?

PEPs were established in section 101 of the Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act), which amended ERISA and the IRC, to allow unrelated employers to join a defined contribution retirement plan maintained by a pooled plan provider (PPP) acting as the plan’s administrator and named fiduciary. A PEP, as defined in Section 101, is an individual account plan established or maintained for the purpose of providing benefits to the employees of two or more unrelated employers as a qualified retirement plan or a plan funded entirely with individual retirement accounts (IRA plan).

A PEP is a type of multiple employer plan (MEP) that allows unrelated employers to participate in a single, shared defined contribution plan, which is treated as a single plan for purposes of satisfying Employee Retirement Income Security Act of 1974 (ERISA) requirements. A PEP is considered to be an “open MEP” because there are no requirements that participating employers be in the same industry or location, nor are there limits to the number of participating employers in a PEP. On the other hand, in a “closed MEP,” the employers must share common interests and/or organizational relationships beyond the provision of benefits. Employers have been able to join PEPs since 2021.

Pooled Plan Providers

A PEP is required to have a pooled plan provider (PPP) that is designated by the terms of the plan as a named fiduciary and plan administrator. The PPP performs certain administrative duties, including conducting proper compliance testing with respect to the PEP and the employees of each employer in the PEP. It is expected that most PPPs will be organizations such as insurance companies, banks, trust companies, consulting firms, record keepers, and third-party administrators. The PPP must register with the Department of Labor. A PEP must designate one or more trustees to be responsible for collecting contributions to, and holding the assets of, the plan and require such trustees to implement written contribution collection procedures that are reasonable, diligent, and systematic. The PPP is responsible for ensuring that all persons who handle assets of, or who are fiduciaries of, the PEP are bonded.

Together but Separate

Joining a PEP does not completely exonerate each employer from its fiduciary responsibilities. Each participating employer in a PEP generally selects from a range of plan provisions, as specified in the PEP plan document and is ultimately responsible for following the selected provisions. Except with respect to certain administrative duties of the PPP, each participating employer in a PEP is legally treated as a plan sponsor with respect to the portion of the plan attributable to employees of such employer (or beneficiaries of such employees) and retains fiduciary responsibility for the selection and ongoing monitoring of the PPP and any investment and management of the portion of the plan’s assets attributable to the employees of the employer to the extent not delegated to another fiduciary by the PPP.

How is a PEP Different from Other Multiple Employer Plans (MEPs) and Multiemployer Plans?

MEPs are maintained by two or more employers for the purpose of pooling investments and sharing administrative costs. MEPs typically maintain separate accounts for each of the employers within the plan, but they are treated as a single plan under the Internal Revenue Code (IRC). However, a MEP may or may not be treated as one plan under ERISA. The DOL has imposed a “common interest” requirement on employers adopting MEPs that must be met if the MEP is to be treated as one plan for ERISA purposes. However, with enactment of the SECURE Act, Congress loosened the common interest requirement for PEPS. Unlike the “closed” MEP “, a PEP is effectively an open MEP because it is not subject to the common interest requirement that applies to other MEPs. As such, PEPs are considered a single plan for both IRS and ERISA purposes. Multiemployer plans are similar to MEPs in that both types of plans are single plans that cover participants of more than one employer; however, multiemployer plans are subject to the terms of a collective bargaining agreement (CBA) between two or more contributing employers (or a group association of employers) and a labor union.

What are the DOL Financial Reporting Requirements for a PEP?

The administrator of a PEP must file an annual Form 5500, Annual Returns/Reports of Employee Benefit Plan, to which the PEP administrator must attach additional information, including a list of employers in the plan, a good faith estimate of the percentage of total contributions made by each employer during the plan year, the total of the individual account balances attributable to each employer in the plan, and the identifying information for the Pooled Plan Provider (PPP). PEPs cannot use the Form 5500-SF to satisfy their annual reporting obligations. They must file Form 5500.

PEPs that have 100 participants or more are required to have an annual financial statement audit.

The SECURE Act did not establish a new audit threshold for PEPs. Therefore, the general rule is that PEPs that cover 100 participants are more are required to have an audit.

Permission Granted Does Not Mean Action Will be Taken

Although Section 101 of the SECURE Act amended ERISA section 104(a)(2)(A) to permit the Secretary of Labor to establish simplified reporting for MEPs subject to ERISA section 210(a) with fewer than 1,000 participants in total, as long as each participating employer has fewer than 100 participants, the DOL is not currently proposing to amend the current reporting rules to establish a “simplified report” for such plans with fewer than 1,000 participants.

Unique Items for Auditors to Consider

- Engagement acceptance: AU-C section 220, Quality Control for an Engagement Conducted in Accordance with Generally Accepted Auditing Standards, addresses the engagement partner’s responsibilities relating to audit client acceptance. It requires the firm to obtain information considered necessary in the circumstances before accepting an engagement with a new client. An important consideration is whether the engagement team is competent to perform the PEP audit engagement and has the necessary capabilities, including time and resources.

- Understanding the entity: The amount of time and effort required to complete the audit will depend on many things, including the complexity of the plan and its operations. AU-C section 315, Understanding the Entity and Its Environment and Assessing the Risks of Material Misstatement, requires that the auditor obtain an understanding of the entity and its environment, including the entity’s internal control. The understanding of the entity should include:

- Relevant industry, regulatory, and other external factors, including the applicable financial reporting framework. For PEPs, additional regulatory considerations will include the provisions of the SECURE Act and its regulations.

- The nature of the entity, including:

- Its operations. The complexity of the PEP’s operations will depend largely on the plan document and plan composition, including the number of participating employers, trustees, custodians, and payroll systems, as well as the extent to which plan provisions are allowed to vary among the participating employers (e.g., definition of compensation, eligibility, vesting, etc.).

- Its ownership and governance structures. The identification of those charged with governance for a PEP will require understanding the responsibilities of the various parties involved (which may be parties outside of the PPP) and how those responsibilities are executed.

- The types of investments that the entity is making and plans to make, including investments in entities formed to accomplish specific objectives.

- The way that the payroll integration is structured and how contributions are funded.

Understanding the PEPs internal control may include not only controls at the PPP, but also the controls at the participating employers that may affect the reliability of data and the design of audit procedures, such as controls over human resources information systems and payroll.

- Audit evidence: AU-C section 500, Audit Evidence, requires that the auditor design and perform audit procedures that are appropriate in the circumstances for the purpose of obtaining sufficient appropriate audit evidence. The entity’s accounting records are an important source of audit evidence. For PEPs, audit evidence may come from various sources, depending on whether transactions are initiated at the PPP or the participating employer level. Discussions, inquiries, and information requests may need to be directed to parties other than the PPP.

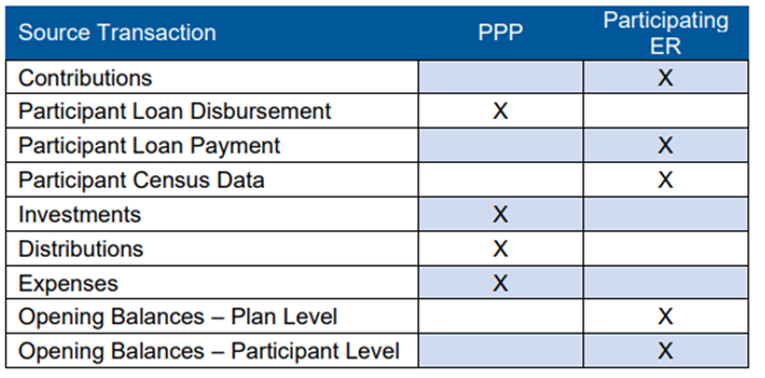

Following is an example of where transactions may be initiated in a PEP.

Note that it may not be possible to fully delegate payroll functions to the PPP since employers must set up new employees pay rates and hours worked on the payroll system, and participant elections may not be set up to be entered directly by participants into the payroll system.

- Economies of Scale: Maybe: The extent to which the PEP will result in lower audit fees per employer than if they had an individual plan will depend on how homogeneous the plan provisions adopted by the member employers are, how many different payroll companies are involved, the level of integration between the recordkeepers and the payroll softwares, the relative significance of each employer’s assets, and the availability of SOC 1 reports for the relevant service providers. A PEP that mandates the same plan design and the same payroll company with full integration with the recordkeeper will have a better chance of lower audit fees than one that allows full flexibility of choice in design and payroll providers. When it comes to PEPs, individuality doesn’t pay off, it makes you pay.

Discarding the Bad Apple

In the past, the “one bad apple” rule jeopardized a plan’s tax qualified status when one employer had an operational failure. When things go wrong, PEP members are not jointly and severally liable for each other’s actions. Under Section 101 of the SECURE Act, a PEP is not treated as failing the IRS qualification requirements solely because a single employer fails to satisfy those requirements, as long as the PEP provides for the transfer of the offending employer’s plan assets to one of various specified arrangements. Noncompliant PEP members are a bad apple turned a hot potato; the PEP has to get rid of it before everybody gets burned. When it comes to PEPs, “All for one and one for all” only applies until something goes wrong.

Originally published in the Summer 2023 Issue of Delaware Banker (Delaware Bankers Association).