Plan sponsors, third-party administrators, and other Form 5500 preparers take note! DOL representatives indicated that in some instances Part III – Accountant’s Opinion, Line 3(a) and 3(b) of the Schedule H is being filled out incorrectly.

Plan sponsors, third-party administrators, and other Form 5500 preparers take note! DOL representatives indicated that in some instances Part III – Accountant’s Opinion, Line 3(a) and 3(b) of the Schedule H is being filled out incorrectly.

Marcus Aron (Division of Accounting Services) and Scott Albert (Division of Reporting Compliance) indicated at the 2023 Joint TE/GE Council Hybrid Meeting that some Form 5500 preparers of retirement plans, whose independent qualified public accountants who performed an ERISA Section 103(a)(3)(C) audit, are answering Part III – Accountant’s Opinion, Line 3(a) and 3(b) of the Schedule H of Form 5500 incorrectly by selecting an incorrect type of audit opinion and/or failing to indicate whether the audit was performed in accordance with ERISA Section 103(a)(3)(C).

Confusion may be warranted because after the Form 5500 was updated to reflect auditing standard changes, the Audit Standards Board postponed the implementation of Statement on Auditing Standards 136 (SAS 136) due to the COVID-19 pandemic. We addressed how to correctly fill out the Form 5500 questions in our blog entitled When the 5500 is Ready for SAS 136, but Your Auditor is Not.

Background

Before I go into the correct answers on Part III – Accountant’s Opinion, it is helpful to give background on the changes. Effective for plan years ending on or after December 15, 2021, SAS 136 changed the type of opinion that was provided on ERISA Section 103(a)(3)(C) audits (formerly limited-scope audits).

It’s important to understand the types of audit opinions. An auditor can give two types of audit opinions – an unmodified opinion or modified opinion. An unmodified opinion (sometimes referred to as a clean opinion) provides that the financial statements present fairly in accordance with the applicable financial reporting framework in accordance with generally accepted auditing standards (GAAS). An auditor may modify his or her opinion by providing a qualified, adverse, or disclaimer of opinion. The modified opinions generally report that financial statements do not present fairly in accordance with the applicable reporting framework (usually this is generally accepted accounting principles [GAAP]) or indicate that there was a limitation in auditing procedures that would preclude an auditor from determining financial statements that present fairly in accordance with applicable reporting framework. A disclaimer of opinion, which is one form of modified opinion, indicates that the auditor was unable to perform certain audit procedures to gain reasonable assurance over the fair presentation of the financial statements. A disclaimed audit opinion usually is a red flag to users of financial statements and regulatory agencies – the Department of Labor actually rejects Form 5500s of retirement plans that received disclaimed opinions other than ones issued for permitted reasons.

Prior to SAS 136, auditors of retirement plans were able to issue a disclaimer of opinion because of the lack of audit testing over assets that were covered under a qualified organization certification. This disclaimer of opinion was allowed by ERISA and, if coded correctly on the Schedule H of the Form 5500, was not rejected by the DOL if the disclaimer was solely because limited procedures were performed on these certified assets. SAS 136 changed the opinion provided from a disclaimer of opinion to a dual-pronged unmodified opinion. This dual-pronged opinion includes an unmodified opinion rather than a disclaimer of opinion.

Form 5500 Selections

So how should the Form 5500, Part III – Accountant’s Opinion section be correctly reported? As noted, for ERISA Section 103(a)(3)(C) audits, the auditor will generally issue an unmodified opinion. Therefore, the Form 5500 preparer will need to complete Part III – Accountant’s Opinion Line 3(a)(1) to report an unmodified opinion. Additionally, in an ERISA Section 103(a)(3)(C) audit, the Form 5500 preparer must fill out Line 3(b)(1) to indicate to the IRS and DOL that an ERISA Section 103(a)(3)(C) audit was performed.

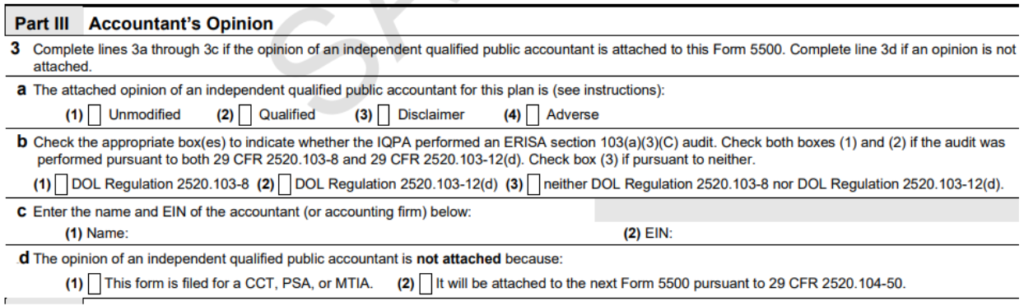

Below is a snapshot from the sample 2022 Form 5500 from the DOL website for reference. To assist the 5500 preparers who ask us how to answer these questions, we created a chart on how to report on the Schedule H, Part III – Accountant’s Opinion based on the type of audit and opinion. Please note that this chart doesn’t encompass all situations, but only identifies the most frequently encountered situations.

| Type of Audit | Auditor Opinion | Form 5500 Part III Selections | |||

| Pre-SAS 136 | |||||

| Limited-Scope | Disclaimer | 3(a)(3) 3(b)(1) |

|||

| Full Scope | Unmodified | 3(a)(1) 3(b)(3) |

|||

| Post-SAS 136 | |||||

| ERISA Section 103(a)(3)(C) | Unmodified | 3(a)(1) 3(b)(1) |

|||

| Non-ERISA Section 103(a)(3)(C) | Unmodified | 3(a)(1) 3(b)(3) |

|||

*Note that the above chart assumes that the audit was not performed pursuant to DOL Regulation 2520.103012(d) (3(b)(2)), so this selection will need to be evaluated for your particular audit.

*Note that other types of opinions for each audit may be provided. The above only reports the most frequent disclosures. Plan administrators will need to discuss the audit opinion with their auditor.

Recommendation

Plan sponsors and Form 5500 preparers should review the Form 5500, Schedule H, Part III – Accountant’s Opinion to ensure that this section is adequately completed. Under SAS 136, auditors must also ensure that there are not material inconsistencies in the answers to the Form 5500. Nothing needs to be updated if Part III – Accountant’s Opinion is filled out accurately. However, a Form 5500 may need to be amended to properly report the auditor opinion and type of audit if this section is not accurately completed.

The DOL has indicated that they will be sending letters out to plan administrators to ensure that this section is completed accurately. To try to identify this issue and correct before a letter is received, plan sponsors should review this section of the Form 5500 and correct as necessary. The DOL is aware that this is a transition year and may be more lenient regarding penalties, but nonetheless, it would be best to address any issues before the DOL comes knocking.