Posted by Maria T. Hurd, CPA

By special request, following is a summary of the basic available safe harbor formulas, with no extra editorials. See bullet points for information about enhanced match opportunities.

By special request, following is a summary of the basic available safe harbor formulas, with no extra editorials. See bullet points for information about enhanced match opportunities.

For those who prefer charts:

| Type of Safe Harbor Plan | Deferral | Match | Compensation Limit | ||||||

| Traditional Safe Harbor Plan | $1 | $1 | Up to 3% of eligible compensation | ||||||

| 100% vesting | + | $1 | .50c | for the next 2% of eligible comp. | |||||

| or better. (Often $1 for $1 up to 4%) | |||||||||

| Automatic Enrollment Safe Harbor Plan-QACA | $1 | $1 | Up to 1% of eligible compensation | ||||||

| 2-year cliff-vesting | + | $1 | .50c | between 1% and 6% of eligible comp. | |||||

| or better. (Often $1 for $1 up to 3.5%) | |||||||||

| Traditional Safe Harbor and QACA | 3% Nonelective Contribution to all Eligible Participants | ||||||||

For those who prefer words, the available safe harbor formulas are as follows:

- Traditional Safe Harbor Plan Match

- A 100% vested dollar-for-dollar match up to 3% of compensation, plus 50 cents for every dollar for the next 2% of compensation, or better, which is often effectively dollar-for-dollar up to 4% of compensation.

- Automatic Enrollment Safe Harbor Plan Match

- An automatic enrollment safe harbor plan is called a Qualified Automatic Contribution Arrangement (QACA). The safe harbor match contribution for a QACA is 100% of elective contributions up to 1% of compensation and 50% of elective contributions between 1% and 6% of compensation, or better. This contribution can be subject to a 2-year cliff vesting schedule.

- Nonelective 3% contribution

- A 3% nonelective contribution to all eligible participants is available for both a traditional safe harbor plan and a QACA.

Now the editorial, in bullet points:

- Enhanced match formulas are available if they meet the following requirements:

- It must be at least as generous as the basic match;

- deferrals in excess of 6% of compensation may not be matched

- the rate of match may not increase as deferrals increase; and

- the rate of the match may not be greater for HCEs than for NHCEs.

- For an example computation of an enhanced match, please refer to our previous blog How to Order a Triple Stack Match for your Plan

- There cannot be allocation conditions, such as a last-day of employment requirement, to receive a safe harbor contribution

- The definition of eligible compensation must be nondiscriminatory

- Safe harbor contributions cannot be withdrawn before age 59½, even for hardship reasons

- Automatic contribution rates must be a uniform percentage of eligible compensation, cannot exceed 10% of compensation, and must satisfy the following minimum percentages:

- 3%: First eligibility period ending on the last day of the year following the eligibility year

- 4%: Second year

- 5%: Third year

- 6%: Fourth year

- Many employers choose an automatic enrollment deferral of 6% to maximize administrative simplicity.

- Changes often lead to errors. Also for administrative simplicity, employers provide a QACA match of $1 for $1 up to 3.5% of eligible compensation.

- The plan must generally be in place before the beginning of the year so that timely written notice of the safe harbor contribution may be distributed to all eligible employees between 30 and 90 days before the beginning of the plan year.

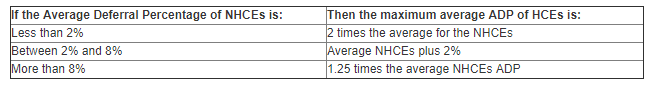

- In general, the Actual Deferral Percentage (ADP) Test and the Aggregate Contribution Percentage (ACP) Tests avoided with a safe harbor plan design are summarized as follows:

- Additional contributions to the safe harbor may trigger discrimination testing.

- For additional discussion of discrimination testing and available corrections, please refer to “Leveling Out ADP and ACP Tests with Refunds, QNECs/QMAcs, Bottom-Up QNECs, or One-to-One Contributions,” and “Explaining Discrimination Test Refunds to HCEs.”

A prospective client’s plea for a concise summary of the safe harbor formulas and rules, without opinions, editorials, or additional context inspired this summary. Unfortunately, the regulatory framework that governs 401(k) plans can never be completely simple and straightforward. In fact, we have a whole series of blogs discussing “Building Safe Harbor Escape Clauses” and “Maybe Notices”. No matter how much we try to explain rules in black and white, in the end, the 401(k) world is full of exceptions. Have I covered all the safe harbor formula possibilities, as requested? Maybe……

Photo by Will McKenzie (License)