Posted by Maria T. Hurd, CPA

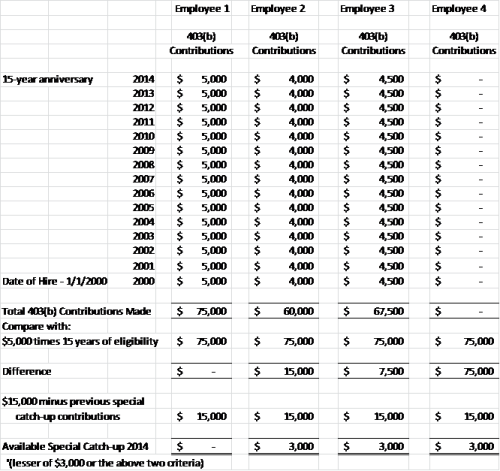

The amount available under the 15-year catch-up provision is based on the number of years of service and the total contributions previously made. Each year, a participant may be entitled to a special catch-up contribution amounting to the lesser of: (a) 3,000 (b) $15,000 minus the prior 15-year catch-up contributions or (c) $5,000 times years of service minus the total amount of 403(b) deferrals contributed” Phew!

As requested by an attendee to a seminar I recently taught to government employees, I have prepared four examples to demonstrate the mechanics of this very complex limitation.

In the plan year ended December 31, 2015, all three of the employees in the above example have completed 15 years of service and are eligible for the 403(b) Special Catch-up Contribution for the first time.

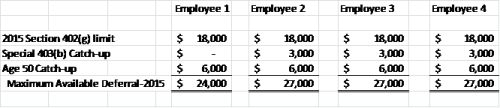

It is important to note that Employees #1, 2, 3, and 4 must defer the maximum deferral under Internal Revenue Code section 402(g), or $18,000 for 2015, before any contribution is attributable to the special catch-up first, and then to the 50-year catch-up contribution. In other words, if Employees #1, 2 , 3, and 4 are 51 years old, their maximum contributions for 2015 would be as follows:

Ordering Rules:

Because the ordering rules require that deferrals in excess of the 402(g) limit be attributed first to the 403(b) special catch-up, and then to the 50-year catch-up, if Employee 2 or 3 defers $25,000 during 2015, then the first $18,000 would be attributed to the maximum deferral under Section 402(g), then the next $3,000 would use up the available 403(b) Special Catch-up for that year and the remaining $4,000 contribution would be attributed to the age 50 Catch-up.

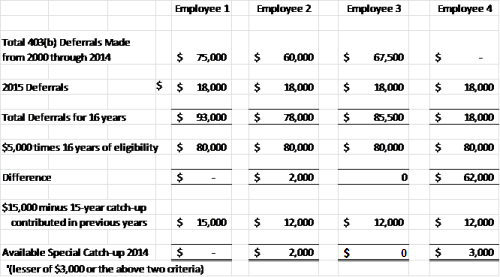

The 403(b) Special 15-Year Catch-up Contribution Computation Must be Performed Annually

In Year 2, the maximum available 15-Year Catch-up available to Employees 1 through 4 is as follows:

Conclusion:

Plan sponsors must make sure that they have the historical information necessary to compute the maximum available 403(b) catchup for each employee. If historical information is not available due to permissibly excluded contracts, then the plan sponsors should consider the wisdom of offering a plan provision that they cannot administer accurately, due to lack of information. If the information is available, the above template is a good tool to document the computation of the maximum available 15-year catchup for every eligible employee taking advantage of an opportunity that is exclusively available to 403(b) plans.