Posted by Tyler Starr

Disclaimer: All blog posts are valid as of the date published.

The use of the wrong definition of compensation is the most common error found in employee benefit plan audits, and it can be a very costly mistake to correct in accordance with the provisions of the IRS’ Employee Plan Compliance Resolution System (EPCRS). To prevent this error from occurring, it is important to understand the plan’s definition of compensation.

The use of the wrong definition of compensation is the most common error found in employee benefit plan audits, and it can be a very costly mistake to correct in accordance with the provisions of the IRS’ Employee Plan Compliance Resolution System (EPCRS). To prevent this error from occurring, it is important to understand the plan’s definition of compensation.

In many cases, the plan’s definition of compensation for contribution purposes is gross compensation. In other cases, plan documents list W-2 wages as plan compensation, but then also require pre-tax contributions to Section 125 and Section 129 plans be added back to the W-2 wages to be included as plan compensation. In both these instances, an accurate plan compensation amount does not appear anywhere on the Form W-2 for employees who make pre-tax contributions to a welfare plan. Hence, when providing compensation data on the census for plan compensation, it is important for the plan sponsor to understand that pre-tax contributions to Section 125 and 129 plans are not taxable for Medicare, but they are part of a participant’s gross compensation, so the amount on Box 5 of the W-2 or the W-3, Medicare Wages, does not represent plan compensation, even when the base definition listed is W-2 wages.

It is an employer’s responsibility to include complete and accurate information on the census data provided to the third party administrator of a 401(k)/profit sharing plan and to reconcile the deferrals reported on the Form W-3 to the deposits to the plan trust. Conversely, it behooves the employees to understand the plan’s definition of compensation to verify the contributions that have been made to their plan accounts.

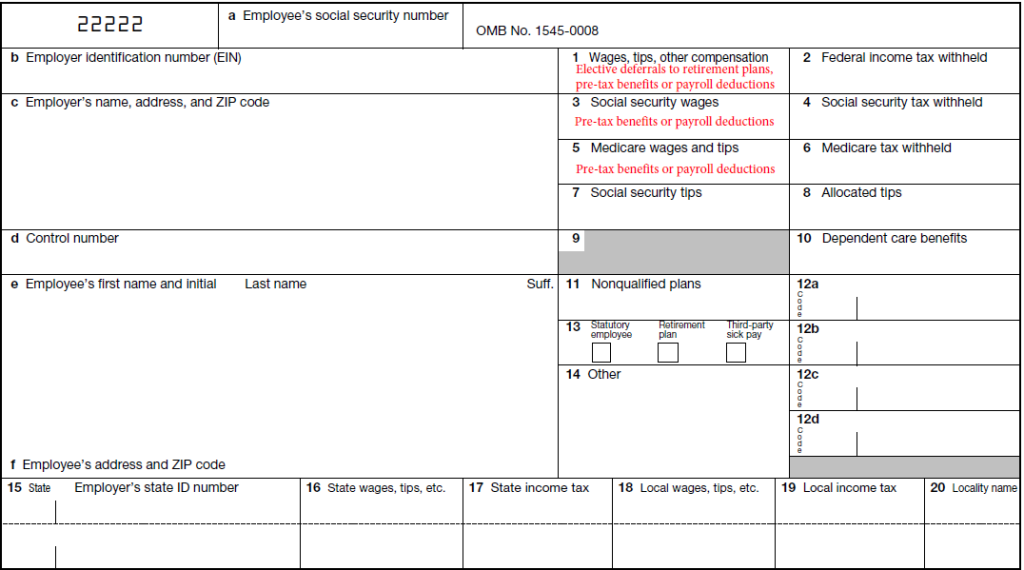

The following image shows what is NOT included in each wage box of the Form W-2:

Box 1 of the Form W-2 (above)

Employers report the total taxable wages for each employee. While many plan documents define compensation as W-2 compensation reported in Box 1, they also proceed to require an addback of all pretax deductions, such as 401(k) deferrals and pre-tax contributions and dependent care contributed to Section 125 and 129 plans. Employer-sponsored retirement plan contributions such as 401(k) and 403(b) plan deferrals will not be included in Box 1 taxable wages, along with deductions such as medical premiums, dependent care, or flexible spending accounts.

Box 3 of the Form W-2 (above)

Box 3 shows the total wages subject to the Social Security tax. Elective contributions to retirement plans are added back here so that they can be taxed for FICA purposes. This amount will never be more than the maximum FICA taxable wage base ($118,500 for 2016 and $126,000 for 2017).

Box 5 of the Form W-2 (above)

Unlike Social Security wages, there is no cap for wages subject to Medicare taxes.

While 401(k) and 403(b) contributions are tax free for federal income tax purposes, they are still subject to FICA and Medicare taxes. So, Boxes 3 and 5 get us closer to gross wages, but are still likely lower than gross wages. This is because participant contributions to a Section 125 cafeteria plan or a Section 129 dependent care plan are not taxable for federal income, FICA, or Medicare taxes. As such, the totals in Box 1, 3, and 5 will not show gross wages because amounts for items such as the employee portion of medical premiums are being excluded. These amounts will have to be added back separately to determine an accurate gross compensation.

Will the real Gross Wages, please stand up!

If compensation is erroneously being excluded, it will result in lower deferrals and possibly lower employer match contributions. When this error is found, the employer will have to make any affected employees whole by depositing a portion of any lost contributions, plus earnings, into the plan. See our blog titled Death Taxes and Plan Errors for the specifics of the correction.

To prevent errors, each plan sponsor should provide complete census information to the third party administrator, starting with gross wages that reconcile to the original-source payroll reports, then adding columns with every type of compensation that is excluded from the plan specifically. Each column total for each type of excluded compensation should be reconciled with the original-source payroll reports. In many cases, the W-2 and the W-3 will not have the information that is relevant for quantifying contribution compensation by person and in total. Plan sponsors should review the plan document to make sure an accurate definition of wages for contributions is provided in the census, but to do so, the starting point should always be gross wages, the elusive gross wages that cannot be found in the boxes of the W-2 or the W-3.

BLS is available to assist employers in producing an accurate census for their third party administrators. Preventing, rather than detecting errors in the definitions of plan compensation provided to the third party administrator can be achieved by first and foremost, asking: Will the real gross wages, please stand up?

Photo by frankieleon (License)