Posted by Saaib Uppal and Stacey Snyder

Disclaimer: All blog posts are valid as of the date published.

As the common adage goes, “A chain is only as strong as its weakest link.” With discussions across the country focusing on the discrepancies in wealth, we thought now is a better time than ever to remind ourselves of the finer details of top-heavy testing to ensure that there is no equivalent of a 60% vs. 40%. Given the amount of research required for this blog compared to some of our others, the name top-heavy is as appropriate as any and we will attempt to answer some frequently asked questions so that you and your company can ensure that you are in compliance.

As the common adage goes, “A chain is only as strong as its weakest link.” With discussions across the country focusing on the discrepancies in wealth, we thought now is a better time than ever to remind ourselves of the finer details of top-heavy testing to ensure that there is no equivalent of a 60% vs. 40%. Given the amount of research required for this blog compared to some of our others, the name top-heavy is as appropriate as any and we will attempt to answer some frequently asked questions so that you and your company can ensure that you are in compliance.

What is a “top-heavy” test?

A top-heavy test is used to ensure that “non-key” employees receive a minimum employer contribution if the key employees of a company owned over 60% of the plan assets as of end of the previous year. This is not to be confused with the Actual Deferral Percentage (ADP) test, which limits the average deferrals of highly compensated employees to a multiple of the average deferrals of the non-highly-compensated employees. There is, in fact, a difference between the definitions of highly compensated employees and key employees.

How do you know if a plan is top-heavy?

Generally, a plan is top-heavy each year that the key employees owned 60% or more of the plan assets as of the last day of the previous year.

Who are key employees?

Generally, employees are considered key employees if they are 5% owners, 1% owners with $150,000 compensation, or officers with compensation of $165,000 for 2012.

An aspect of this rule that is often overlooked is family attribution. Employees are deemed to own the stock owned by their spouse, parents, children, and grandchildren. Note that there is no attribution among siblings. Additionally, relatives of key employees who meet the 5% rule are also considered key employees, regardless of their compensation level, and relatives of 1% owners are considered if their wages also were at least $150,000.

It is important to identify all of the key employees accurately since any one of them could be the difference between the plan being top-heavy or not. For example, husbands and wives may not always have the same last name. The married daughter of a key employee could have her husband’s last name. A retired shareholder who remains employed could still be considered a key employee, along with his 7-digit account, if the son took over the business ownership. Unless the client informs the Third Party Administrator (TPA) of these relationships, one or the other may be excluded from the list of key employees.

What if the plan is top-heavy?

If the plan is deemed to be top-heavy the employer must make a contribution that is equal to the lower of 3% of ANNUAL compensation or the highest contribution rate allocated to a key employee, including their deferrals. The contribution must be made to every non-key employee employed on the last day of the plan year.

Additional requirements

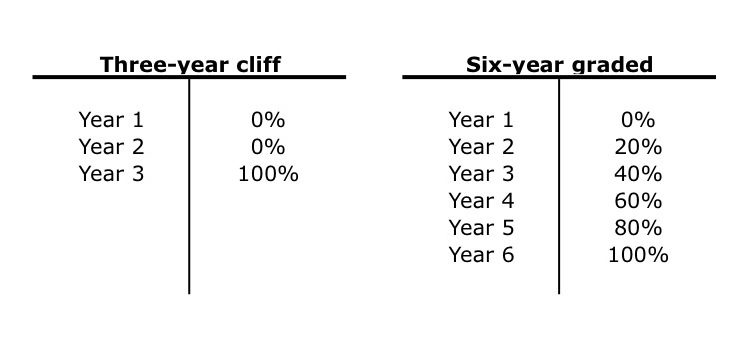

Top-heavy contributions must offer one of the following vesting schedules or better:

It is important to note that the top-heavy schedule must be at least as favorable as the regular vesting schedule for every participant. BLS once audited a plan which offered three-year cliff vesting for top-heavy purposes and six-year graded vesting for regular purposes. As you can see from the side-by-side schedules above, participants with two years of service did not receive more vesting under the top-heavy schedule than under the regular vesting schedule. As a result of the plan defect, the employer paid 20% vesting to any participant who had taken a distribution after 2 years of service for every previous year in which the plan was top-heavy.

Exemptions

Safe harbor 401(k) plans as described in the previous blog entry, KISS-Keep it Simple and Straightforward, are exempted from top-heavy testing. However, if the employer elects to contribute an additional discretionary profit sharing contribution, then the top-heavy rules kick in.

The Internal Revenue Service requires top-heavy tests to ensure that certain minimum benefits or contributions are being made to the non-key employees. In a way, they are ensuring that the 60-40 does not become 99-1 without non-key employees getting their fair share. The goal is not to make the stronger link weaker but rather to make the weaker link stronger.

Photo by elycefeliz (License)