The 2023 Form 5500 Annual Return/Report of Employee Benefit Plan includes some changes to previous filing requirements as published in the Federal Register ) and documented in the 2023 Form 5500 instructions. As discussed in our previous blogs “Learning How to Count Again” and “Counting What Counts, Counts the Auditors Out!,” one change was to the participant-counting methodology, specifically for defined contribution plans, to determine the plan filing type. A plan is considered a “small-plan” filer if the plan covers fewer than 100 participants at the beginning of the plan year or a “large-plan” filer if the plan covers 100 or more participants at the beginning of the plan year. The plan filing status (either as a small plan or large plan) is an important consideration because it determines what needs to be filed with the government. Large plan filers will generally be required to include more information and incur more costs due to the requirements to attach an independent qualified public accountant audit report to the Form 5500 filing.

The 2023 Form 5500 Annual Return/Report of Employee Benefit Plan includes some changes to previous filing requirements as published in the Federal Register ) and documented in the 2023 Form 5500 instructions. As discussed in our previous blogs “Learning How to Count Again” and “Counting What Counts, Counts the Auditors Out!,” one change was to the participant-counting methodology, specifically for defined contribution plans, to determine the plan filing type. A plan is considered a “small-plan” filer if the plan covers fewer than 100 participants at the beginning of the plan year or a “large-plan” filer if the plan covers 100 or more participants at the beginning of the plan year. The plan filing status (either as a small plan or large plan) is an important consideration because it determines what needs to be filed with the government. Large plan filers will generally be required to include more information and incur more costs due to the requirements to attach an independent qualified public accountant audit report to the Form 5500 filing.

What Changed?

As a quick refresher, for 2022 and prior Form 5500s, the beginning of year participant count included employees that were eligible to participate, regardless of whether they were participating in the plan, plus terminated participants with account balances, to determine the plan size. In some cases, plans with low participation could have 100 or more eligible participants, but very few account balances. The requirement to count eligible employees who were not participating caused plans with fewer than 100 account balances to be required to file as a large-plan filer that required an independent qualified public accountant audit report. At the national level, the number of large plan filings was expected to decrease from 86,744 to 68,057 when the counting methodology changed to include only participants with account balances: a 22% reduction. BLS experienced an equivalent reduction in the number of clients that required an audit due to the new participant-counting methodology.

Current Requirements

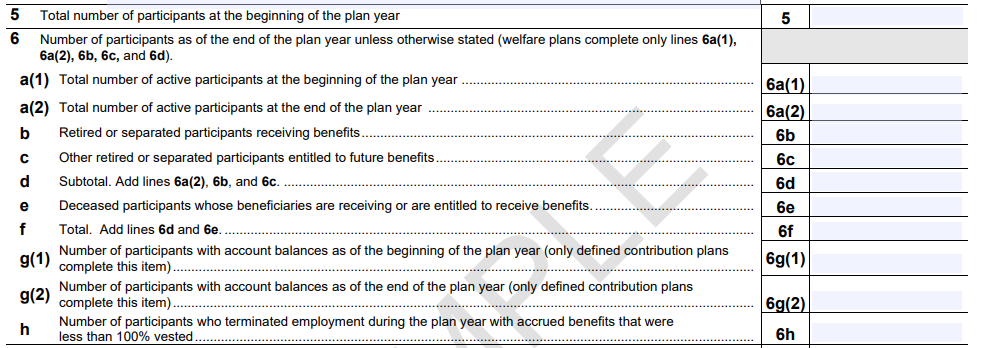

For 2023 and subsequent Form 5500 filings, defined contribution plans will count the number of participant account balances at the beginning of the plan year to determine if the plan is a “small-plan” or “large-plan” filer. As noted below, the 2023 Form 5500 added line 6g(1), which identifies the number of participants with account balances as of the beginning of the plan year. This number will be used to determine the plan’s “small-plan” or “large-plan” status. Previously, plans would use line 5 to determine the filing status.

There is an exception to the 100-participant count rule, called the 80 -120 exception. This exception continues to apply to the 2023 and future Form 5500 filings. This exception states that if a plan covers between 80 and 120 participants at the beginning of the plan year, the plan may complete the return in the same category as in the previous plan year. So, a small-plan filer that went over the 100-participant account balance threshold in 2023, can still file as a small-plan filer until the plan has more than 120 participant account balances at the beginning of the plan year.

First Plan Year Caveat

Now that we understand the changes to the counting methodology, there is an important caveat for first plan year filers. As mentioned above, a defined contribution plan will use line 6g(1) number of participants with account balances as of the beginning of the plan year to determine the reporting status: as a small plan or a large plan. When a plan starts, there are no account balances at the beginning of the plan year until contributions begin. Under the old counting methodology, new plans reported participants on the first day of the plan’s existence based on eligibility. Since the intention of the new rules was not to eliminate audits for all first year plans, the 2023 Form 5500 instructions indicate that for plans that check Form 5500, Part 1, Line B to indicate that the plan is “the first return/report,” then a plan will use the end of year participant account balances to determine the filing status of the plan for the plan year. This is a pretty straight-forward requirement, but one that is important to note since it is different than prior years.