Posted by Stacey I. Snyder, CPA, QKA, TGPC

Disclaimer: All blog posts are valid as of the date published.

Our lives are filled with limits: speed limits, credit limits, time limits, and a number of different retirement plan limits.

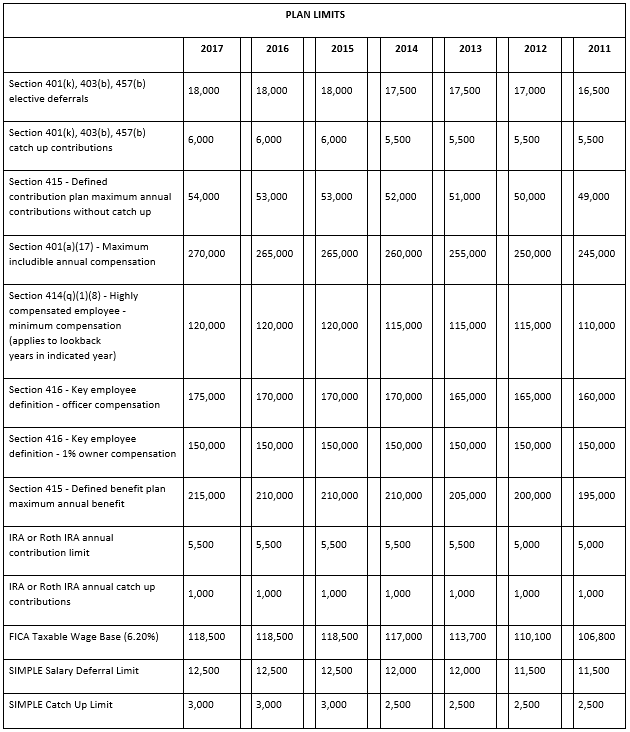

Just like the speed limit on a road you don’t frequently use, it’s not easy to remember a retirement plan limit that hasn’t been applicable since five years ago. We run into this often when we are hired to complete multiple years’ audits at once for plans that have fallen out of compliance. We understand that the process of finding all of the applicable limits going back a number of years, in addition to collecting all other required data, can be overwhelming to plan sponsors. In order to help make that task a little more bearable (and hopefully help you meet your time limit), we’ve compiled all of the plan limits you’ll need into one organized chart.

Contact Us

If you have questions or seek additional information on this subject, please contact our Employee Benefit Plan Team.

Maria T. Hurd, CPA

Director/Shareholder

Retirement Plan Audit Services

mhurd@belfint.com

302.573.3918

Chris J. Ciminera, CPA, QKA

Manager – Accounting & Auditing

cciminera@belfint.com

302.573.3953

Photo by KOMUnews (License)