Posted by Chris Ciminera

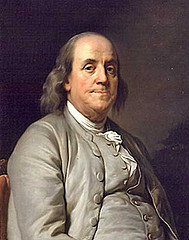

Benjamin Franklin once said, “In this world nothing can be said to be certain, except death and taxes.” Another certainty that comes to mind is change, specifically, changes to the Financial Accounting Standards Board (FASB) Accounting Standards. Every year, accountants’ inboxes are inundated with various Accounting Standards Updates (or ASUs for short). These ASUs quickly become the hot topic to be discussed in staff meetings, informative whitepapers or even around the water cooler. One ASU that has received a lot of attention recently is the FASB’s amendment to their Fair Value Disclosure requirements. The new provisions require the reporting entity to disaggregate their investments into “classes,” expand the requirements to disclose transfers among the fair value hierarchy levels and provide more information on valuation techniques. Altogether, these provisions should help financial statement users to understand the reporting entity’s portfolio risk.

Benjamin Franklin once said, “In this world nothing can be said to be certain, except death and taxes.” Another certainty that comes to mind is change, specifically, changes to the Financial Accounting Standards Board (FASB) Accounting Standards. Every year, accountants’ inboxes are inundated with various Accounting Standards Updates (or ASUs for short). These ASUs quickly become the hot topic to be discussed in staff meetings, informative whitepapers or even around the water cooler. One ASU that has received a lot of attention recently is the FASB’s amendment to their Fair Value Disclosure requirements. The new provisions require the reporting entity to disaggregate their investments into “classes,” expand the requirements to disclose transfers among the fair value hierarchy levels and provide more information on valuation techniques. Altogether, these provisions should help financial statement users to understand the reporting entity’s portfolio risk.

To begin, let’s recap what the original fair value disclosures required: Assets and liabilities that are reported in the financial statements at fair value are to be segregated into one of three buckets in the footnotes based on the valuation technique, or input(s), that was used to determine that asset’s or liability’s fair value. Investments are almost always shown at fair value on the financial statements so we will focus our discussion there. Level 1 contains investments whose reported values represent prices quoted in an active market (e.g., a mutual fund traded daily on the New York Stock Exchange). Level 2 contains investments whose reported values are based on other significant and observable inputs. For example, a corporate bond that is traded only once every few days would typically be classified as a Level 2 investment. Level 3 contains all other investments and specifically those which are valued using unobservable inputs. An example of a typical Level 3 investment would be a private equity fund because the market value comes directly from the underlying fund manager. The total value of investments classified in these three fair value hierarchy levels must agree to the financial statements. In addition, the original pronouncement required more disclosures for Level 3 investments than those which were required for investments in Levels 1 and 2.

The amendment requires that a reporting entity must now disclose the following:

- the amount of transfers between Levels 1 and 2 (previously, the requirement was just between Levels 2 and 3),

- gross activity in the rollforward of Level 3 investments (previously, the requirement allowed net activity to be shown),

- additional disclosures about inputs and valuation techniques used for recurring and nonrecurring fair value measurements for investments that fall in Level 2 or Level 3, and lastly,

- The disaggregation of investments into “classes.”

I want to focus particularly on the last requirement. The amendment requires a reporting entity to break down each investment type into “classes” that indicate investment risk. For example, instead of showing all common stocks on one line item in the fair value note as previously allowed, the reporting entity must disaggregate the total common stocks into relevant classes using classifications such as geography or industry. Mutual funds would be disaggregated according to basic investment strategy. The level of disaggregation is subjective since there is no specific guidance on how the investments should be broken down. As a result, financial statement presentations may vary significantly because each reporting entity could have a different interpretation for how to disaggregate the investments.

Although there has been a constant pattern of change with new standards and additional clarifications from the FASB, each change results in a little more transparency. The increased detail that entities now have to report will help users identify the nature and risk of assets that a plan holds.

If Benjamin Franklin had lived in modern times, he would have added FASB disclosure changes to his list of certainties, or perhaps, death by FASB disclosure changes.

Photo by elycefeliz (License)