Posted by Saaib Uppal, CPA

Disclaimer: All blog posts are valid as of the date published.

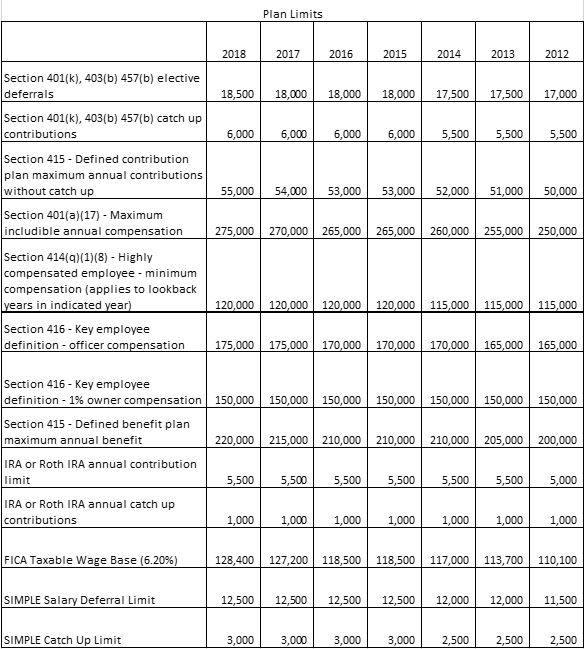

As required by IRC Section 415, the IRS has announced cost-of-living adjustments that should be noted for retirement planning purposes.

Below is a chart that outlines employee benefit plan limits for 2018:

Plan administrators should ensure they pass along this new information to their participants so they have all the required information when planning out 2018.

Contact Us

Maria T. Hurd, CPADirector/Shareholder – Retirement Plan Audit Servicesmhurd@belfint.com302.573.3918Chris J. Ciminera, CPA, QKAManager – Accounting & Auditingcciminera@belfint.com302.573.3953