Posted by Chris Ciminera, CPA, QKA

Disclaimer: All blog posts are valid as of the date published.

In my previous blog, “The Voluntary Fiduciary Correction Program – Overview”, I discussed the Voluntary Fiduciary Correction Program (VFCP). Now, I would like to continue on this topic and explain how to file a VFCP application.

In my previous blog, “The Voluntary Fiduciary Correction Program – Overview”, I discussed the Voluntary Fiduciary Correction Program (VFCP). Now, I would like to continue on this topic and explain how to file a VFCP application.

How Do I File a VFCP Application?

The Employee Benefit Security Administration (EBSA) provides a model application form. A plan sponsor utilizes this form to report the plan, the transaction that was corrected, the correction amount, a description of the parties involved, when the breach occurred, and how the breach was corrected.

As an example, let’s say that a plan sponsor (ABC Corporation) made a late deposit of the deferrals related to the August 1, 2014 through August 14, 2014 payroll, paid to employees on August 19, 2014. The total amount of deferral withholdings from employee’s paychecks was $10,000 and the $10,000 was deposited to the custodian of the plan on September 30, 2014.

Determining what pay periods are deposited late is a source of continual confusion. The EBSA has provided that deferral withholdings must be deposited as soon as the assets can be segregated from the employer’s assets, but that in no event can the deposit be made later than the 15th business day of the month following the month of withholding. EBSA has emphasized that the latest date provision is not a safe harbor, however, and that a plan sponsor should deposit employee deferrals as soon as the funds can be reasonably segregated from its own assets. As such, if a plan sponsor deposits one paycheck’s deferrals on the day that employees are paid and then another paycheck’s deferrals on the following day, then the EBSA can consider the second payroll’s deferral deposits to have been made late. Their contention could be that if it is possible to deposit the deferral withholdings on the pay date, then why did it take two days for the other payroll? During a recent webinar, Mike Horton, the Associate Regional Director of the EBSA of the Philadelphia Region indicated that he believes that large plan sponsors (generally with over 100 participants) should not take longer than one or two days to deposit deferral withholdings.

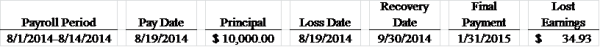

If the plan sponsor determines that a deferral deposit is late, the following spreadsheet can be used to streamline the VFCP application:

Principal – Principal is the total deferrals and loan repayments withheld in the respective pay period. Do not present the principal amount by participant.

Loss Date – The loss date is the date that deferrals should have been made. I’ll assume that ABC Corporation had deposited the deferrals for all of the company’s other payroll periods on the day that employees were paid. Therefore, the pay date of August 19, 2014 is the loss date.

Recovery Date – The recovery date is the date or which deferrals were deposited to the custodian. In my example, September 30, 2014 is the day that the withholdings were deposited to the custodian.

Final Payment Date – The final payment date is the date that lost interest is deposited to the custodian. In my example, I indicated that lost earnings were deposited to the custodian on January 31, 2015. The calculation of lost earnings may be done manually by a number of different methods; however, the DOL has an online calculator that helps determine lost earnings on the principal amount.

What Proof Needs to Be Attached?

- Proof of the principal (deferral and loan repayments) deposited to the custodian.

- Proof of the subsequent deposit of lost earnings.

Prohibited Transaction and Taxes

Late deferral deposits are considered a prohibited transaction and as such are subject to excise tax, unless a notice is provided to participants. There are three options to comply with final correction of the prohibited transaction, as follows:

- Provide a notice to participants

- Allowed if the transaction falls under the prohibited transaction exemption 2002-51, in which the deferral deposit is not more than 180 days late and the plan sponsor has not taken advantage of this exemption for a similar transaction in the last three years. This relief allows the plan sponsor to provide notice to each participant (in lieu of paying excise tax) or to pay the excise tax (in lieu of providing participant notice if the plan sponsor does not want to disclose the violation to plan participants). This notice must be made to all participants within 60 days of the VFCP application, must include language seeking VFCP and PTE 2002-51 relief, must describe the error and correction, give the participant 30 days to make comments to the EBSA, and provide the EBSA regional office’s contact information.

- Pay excise tax to the plan, or

- Pay excise tax to the IRS

- Reported on Form 5330. In this case a copy of the 5330 must be included in the VFCP application with proof of payment to the U.S. Treasury.

Does the VFCP Application Open a Plan up to Audit?

No. Filing a VFCP application does not open a plan up to audit, itself.

Photo by DonkeyHotey (License)