Posted by Saaib Uppal, CPA

This blog post is valid as of the date published.

Along with the presidential election today, Tuesday, November 8, another election that participants should have on their mind is the deferral for their retirement plan. Although the recent IRS announcement indicated that the 401(k) deferral limits did not increase, employees who are not deferring the maximum should fight inertia and reevaluate their contribution levels.

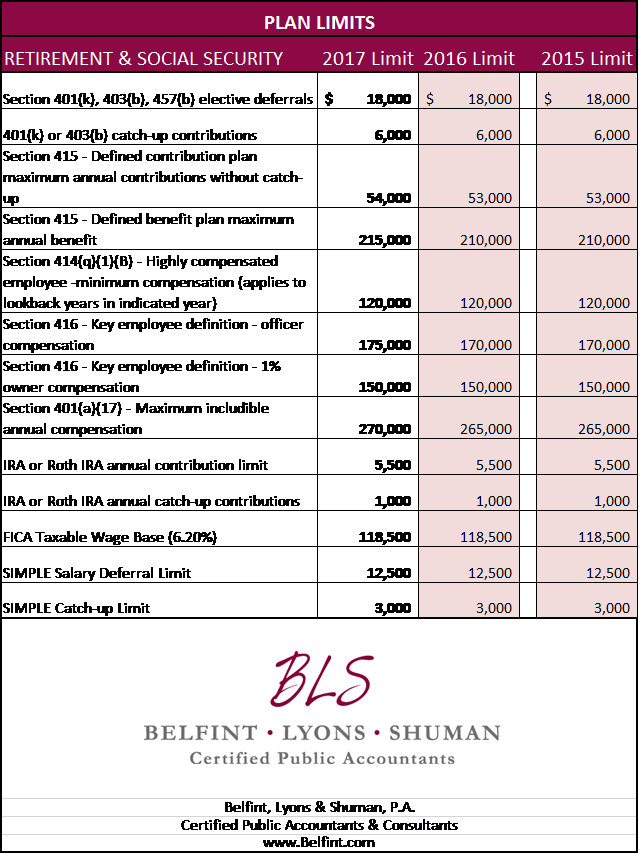

Below is a chart that outlines employee benefit plan limits for 2017:

Even if the cost of living adjustments affecting dollar limitations for retirement plans did not meet the statutory thresholds to trigger an adjustment to the deferral and catch-up maximum contributions, other limitations did increase. All retirement plan participants should take a moment when they make time to vote in the presidential election to consider other elections they make in their lives, like their 401(k) or 403(b) deferral elections. Although there is no one-size-fits-all answer to how much participants should contribute to their 401(k), one answer is indisputable: It never hurts to save more.