Posted By Christopher Ciminera, CPA

Disclaimer: All blog posts are valid as of the date published.

I recently heard a discussion about variations in how people pronounce certain words. People may vehemently defend their pronunciation as the correct version. For example, do you say “toe’may’toe” or “toe’mah’toe”? Or do you say “coo’pon” or “q’pon”?

I recently heard a discussion about variations in how people pronounce certain words. People may vehemently defend their pronunciation as the correct version. For example, do you say “toe’may’toe” or “toe’mah’toe”? Or do you say “coo’pon” or “q’pon”?

As in this example, there are two different ways to compute the late deferrals to report as prohibited transactions, depending on whether you are completing the Form 5330 (Return of Excise Taxes Related to Employee Benefit Plans) or answering the questions on Form 5500, Schedule H, and its related supplementary schedule.In this case, though, there is a correct way for each situation as follows:

- Form 5330 Purposes – Plan sponsors report only the interest on late deferrals for purposes of considering the amount of the prohibited transaction subject to excise taxes.

- Supplementary Schedule of Delinquent Participant Contributions – Plan sponsors report the entire deferral amount that was deposited late as the prohibited transaction.

Background

The Internal Revenue Code (IRC) and Employee Retirement Income Security Act (ERISA) definition of retirement plan prohibited transactions includes the lending of money or other extension of credit between the plan and a disqualified person. The Internal Revenue Code provides a list of transactions that are exempt from the prohibited transaction rules, and if the transaction is not specifically listed, it is considered a nonexempt prohibited transaction.

An employer is required to deposit deferrals withheld from participant paychecks as soon as it can reasonably segregate the assets. The Department of Labor (DOL) has unofficially stated that large plans should be able to segregate the assets within a couple days of the related pay date and small plans can adhere to a seven-day safe harbor. If these rules aren’t followed, the DOL considers the late deposit as a loan from the plan to the plan sponsor. Upon investigation, the DOL could consider deposits outside of an established deposit pattern to be delinquent participant contributions. Also, during our financial statement audits, we analyze patterns of deposit and we may identify possible delinquent participant contributions that need to be corrected. When a deposit is determined to be late, interest must be paid to each affected participant and an excise tax must be paid on the prohibited transaction unless the employer files a Voluntary Fiduciary Compliance Program application. The excise tax is paid with the Form 5330.

Determining the Two Ways to Compute the Prohibited Transaction Amount

Unlike other gray areas, such as how to properly pronounce “dayta” vs. “dahta,” there is clear guidance on how to compute the prohibited transaction amount in each situation.

Form 5330 Reporting

U.S. Code Section 4975 states “solely for purposes of calculating the prohibited transaction excise tax under 4975, the amount involved if an employer does not timely pay the participant deferrals or contributions to a qualified plan is based on interest on these elective deferrals.” This means that only for purposes of calculating the prohibited transaction excise tax under 4975, the interest is the amount considered in the prohibited transaction.

Form 5500 Reporting

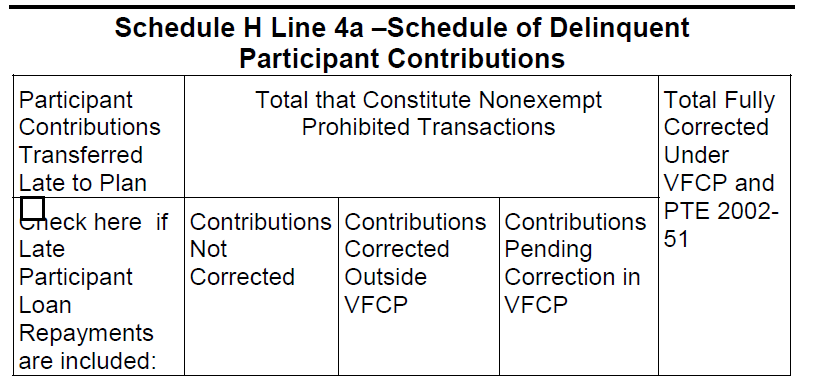

Delinquent participant contributions must be reported on Form 5500, Schedule H, Line 4a. When amounts are reported on Line 4a, a schedule must be attached using the format below, as required by the Form 5500 instructions.

The DOL has a Frequently Asked Question (FAQ) titled “Reporting Delinquent Participant Contributions on the Form 5500,” which gives clarification on how to report the amount of nonexempt prohibited transactions on the schedule of delinquent participant contributions. These excerpts indicate that the total amount of delinquent participant contributions, not just the interest as in Form 5330, should be reported as nonexempt prohibited transactions on this schedule. Specifically, the FAQ states, “…plan administrators and IQPAs should understand that all delinquent participant contributions required to be reported on Line 4a are nonexempt prohibited transactions unless the delinquency has been corrected under the VFCP and the conditions of PTE 2002-51 have been satisfied.”

With retirement plans, as in our English language, there’s more than one way to skin a cat. If there was only one way to handle every situation, there wouldn’t be such a need for retirement plan professionals to interpret all the convoluted rules. Like the myriad of pronunciations and idiomatic phrases typical of different English-speaking places, the DOL and the IRS ensure that their twists and variations will make our jobs more colorful and interesting. Variety is the spice of life!

Photo by Penn State University Libraries Architecture (License)