Posted by Saaib T. Uppal, CPA

Corbin Blue may not have been targeting plan participants as his audience when he told us to “push it to the limit” but what would those limits be if he was? Well, we know what they are for 2015, thanks to a recent IRS announcement.

Plan administrators should ensure that they pass along this new information to their participants so that they too can “push it to the limit!”

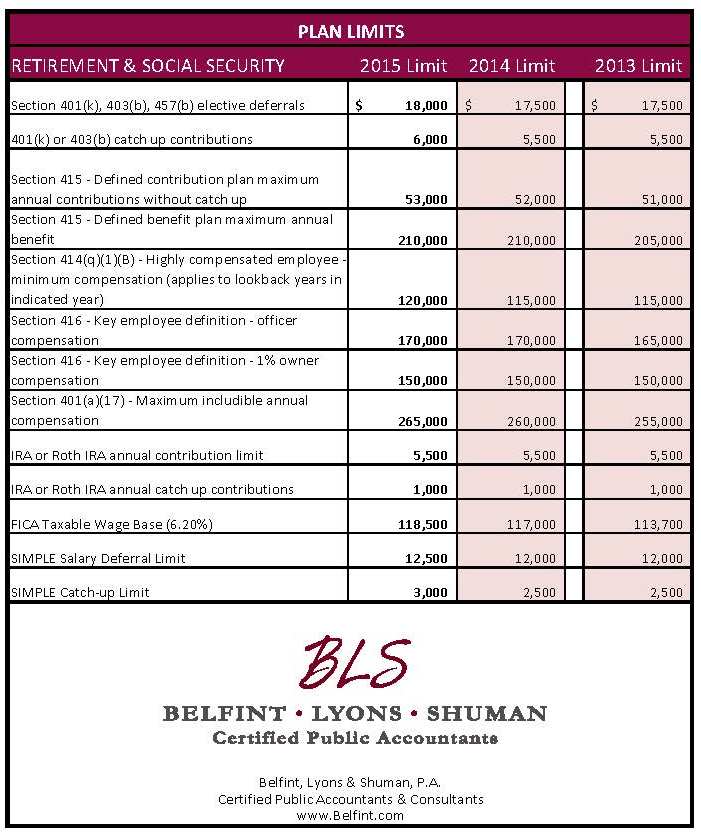

Below is a chart that outlines the recently announced cost-of-living adjustments affecting retirement plans: